1 Indian Institute of Foreign Trade, New Delhi, Delhi, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Financial inclusion is a goal vigorously followed by all governments the world over. Nowadays, due to technological progress, the interplay of technology with the provision of financial services is increasingly becoming quite common and yielding the desired results. The Indian technology landscape has moved fast facilitated by a huge amount of public investment. The ‘Unified Payments Interface (UPI) moment’ has become a cliché in financial circles. From the UPI moment in payments, we are now experiencing high growth in lending and insurance. Partnerships between legacy insurers and InsurTech and e-commerce platforms/networks are leading to new competencies and new, innovative insurance products. The study suggests that embedded, personalised and customised insurance products must be experimented with and introduced in government marketplaces which attract many small buyers and suppliers.

Embedded insurance, technological progress, new partnerships, personalisation and customization

The Embedded Revolution in India

Embedded insurance with online spends on products/services is seeing an exponential growth as customers find usage-based instead of time-based insurance relevant and convenient. Thus, even short journeys undertaken on a daily basis can be insured at the time of booking/payments itself, as companies like Uber and Ola have shown us. Insurance is now getting embedded into financial services too and therein lies the key to increasing the broadening and deepening of the formalisation of the economy. Lenders, for example, are able to lower their risks substantially by embedding insurance into loan contracts for both individual and corporate unsecured/partially secured borrowings. The borrowers, through such insurance, may also be saved from falling into debt traps; however, the insurance product is designed with an aim to protect the lenders’ interests. Borrowers, too, need protection against fake lending apps, frauds in loan contracts and coercive collection behaviour of lenders. Such kind of embedded insurance in borrowings will be based on entirely different parameters from the current lender-focussed insurance available now. Similarly, depositors need to be insured adequately. Even in such heavily regulated entities as banks, there is only a meagre insurance for the depositors. We have seen far too many cases of bank failures wiping out the depositors’ money with some of the senior citizens even losing their lives due to the shock of losing their entire life savings. The same is the case with SMEs, with firms already starved of working capital, facing tremendous hardship when their deposits disappear altogether when lenders get into difficulties. Good deposit growth is key to the formalisation of the economy and that will happen primarily when depositors know that their money is safe. Safety is a hygiene need which can be provided through embedded insurance by private insurers in the absence of government/federal insurance. Through technology, FinTechs may have enabled the banks to get more depositors and deposits but they have not enabled the depositors to get more safety for their deposits. Similarly, deposits with other financial institutions need to be protected, even if it comes at a slightly higher cost for the depositors. And, the argument can be extended to corporate deposits and corporate debt instruments too such as non-convertible bonds/debentures. Today, depositors or investors in debt instruments have to depend entirely on rating agencies to gauge the safety of their investments. Rating agencies have also come under watch at times when their ratings have differed widely from the actual situation that got developed later.

Another area where insurance is likely to benefit substantially is trade credit. Currently, trade credit insurance is available only for international trade. While it is correct that risks in international trade far outweigh those in domestic trade, it certainly is the case that risks in domestic trade remain at elevated levels as delays in receiving payments are very common in the case of small firms. SME credit is rather constrained despite present mechanisms facilitating bill discounting such as factoring or forfaiting. These mechanisms facilitate the transfer of risks of non-payment by the buyers to the factoring or forfaiting agencies. These agencies manage these risks in different ways including insurance. This benefit of insurance should be available directly to the traders through embedded insurance.

Insurers are now much more agile and open to adopting new business models. A sandbox approach to innovation has been adopted by the insurance regulators as well quite like that adopted by the central banks in most countries. The Indian insurance regulator—Insurance Regulatory and Development Authority of India (IRDAI) has set up a mission of ‘Insurance for All’ by 2047. Today, the insurance sector in India is growing at a compound average growth rate (CAGR) of approximately 40%. Apart from life and asset insurance, crop insurance has received a big boost from the government-led crop insurance scheme bringing multiple stakeholders onto a single platform. The reinsurance market has also set its firm foothold in India showing a CAGR of 18–20%. These are ripe conditions for a truly all-encompassing transformative experience into embedded insurance for consumers and small businesses in India.

Impact of Technology on Financial Inclusion

Financial inclusion is a goal vigorously followed by all governments the world over. Several researchers like Aduda & Kalunda (2012); Izaguirre, et al. (2016); Schuetz & Venkatesh (2020); Didenko & Sidelnyk (2021) and Ozili (2022) have all worked on different aspects of financial exclusion including impact of insurance and technological innovations,such as block chain technology and central bank digital currency (CBDC). Nowadays, due to technological progress, the interplay of technology with the provision of financial services is increasingly becoming more common and yielding the desired results. Technology interventions have helped take financial services to the remotest areas at an affordable cost; thereby, giving a chance to the unbanked and under-banked to participate in the formal economy (Bansal, 2014) and (Al-Mudimigh & Anshari, 2020). In India, the PM Jan Dhan Yojana scheme set a firm foundation for innovations in the banking and technology space (Singh, 2017). Muneeza et al. (2018) advocated the use of crowdfunding and blockchain technology to promote financial inclusion. In China too, a combination of financial literacy and the use of digital financial products has been advocated to propel financial inclusion (Agarwal et al., 2020). Technology when combined with ease of access to insurance products accelerates the process of financial inclusion.

The Rise of Embedded Financial Services

The supply of financial services has seen a staggering rise after non-financial entities like e-commerce firms, travel and tour operators, hospital chains and so on have begun offering limited financial services mainly in partnership with financial institutions. Technological innovations have enabled the sharing of core banking infrastructure with non-banking and non-financial companies through Application Programming Interface (APIs). Investment banks like J. P. Morgan now openly encourage non-financial companies to offer financial services to their customers/investors by integrating their banking stack or financial tools such as money management, account services, real-time payments and so on into their own platforms. This transformation in finance also referred to as decentralised finance or open finance would have been unthinkable even a few years ago as finance and particularly banking is a highly regulated industry. This ability of non-financial companies to offer financial services to their customers under their own name without a banking licence is truly remarkable. In India, there are several popular Banking as a Service (BaaS) platforms and some of the deals that have caught attention in recent times are the following:

Thus, embedding banking services into the products of non-banking companies has taken off in a big way and for these partner companies, this arrangement has provided a huge advantage in retention and growth of customer base. The new customer acquisitions have included the unbanked and the under-banked and thereby advanced the goal of financial inclusion.

Embedded Insurance: The Next Phase in FinTechs and Financial Inclusion

Globally, the rise of FinTechs in the insurance sector has led to the rise of ‘usage-based’ insurance rather than ‘time-based’ insurance products. Usage-based insurance is prevalent in case of inter-connected devices that enable vehicle monitoring as well as vehicle-driver monitoring through sensors. This helps companies not only achieve faster claim processing in case of any damage or loss but also nowadays in paying compensation to policy holders even without their filing a claim. Pay-as-you-go models have been quite popular for purchases of items like off-grid electricity in many countries and now these models are being applied in the insurance sector as well. Pay-as-you-drive (PAYD) models have been introduced by new-age InsurTech companies such Acko, Digit and so on in many countries which provides an incentive to drivers to reduce the premium amount and thereby remain insured. Advocates of the PAYD scheme feel it promotes fairness, affordability, traffic safety and environmental objectives (Litman, 2005). Companies like BMW make use of in-vehicle date recorders to provide connected drive services to their consumers. Examples of such services are automatic repairs through software updates and the use of the IoT technology, connections for smartphones and entertainment offerings and so on. The recent boom in wearables has given a spurt to a new pay-as-you-live insurance model in the health sector. Through interconnected devices, current data on the lifestyle of users is transferred including the amount of exercise time and data on all vital signs during and after high activity periods. Pay-as-you-go models have attracted substantial private investment and have experienced compound growth rates hovering around 140% in Eastern African countries helped by the widespread use of mobile phones (Barry & Creti, 2020). Travel insurance even for short journeys by taxi has been facilitated by companies like Uber and Ola. This sachetisation of insurance products or bite-sized insurance is driven not by the need to develop products for the low-income sections of population but by the need to develop ‘fit-for-purpose’ insurance products.

While the partnership of FinTechs with banks have led to a mature level of customisation and personalisation of banking services, in the case of insurance services, the early signs of success have started to become visible even in countries with low levels of insurance penetration. In India, the online insurance business is experiencing high growth rates with customers demanding personalised insurance products. The digital insurance marketplace during COVID period jumped to 54.3% of the online insurance industry. Yet, there is tremendous scope as industry reports reveal that only a third of insurers have partnered with FinTechs even globally.

PhonePe’s forays into insurance began first in 2020 when it obtained a limited ‘corporate agent’ licence and later in 2021, it received the insurance broking licence from the regulator IRDAI allowing it to offer insurance products of all insurance companies. Starting with general insurance, it has grown fast with monthly subscription plans for health insurance introduced in 2023.

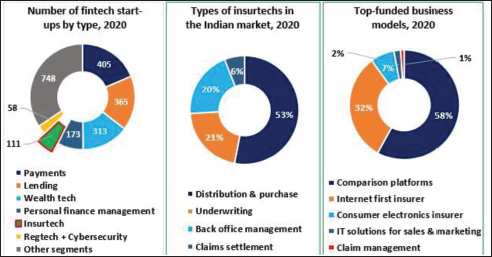

Technology-driven insurance start-ups succeeded in mobilising investor interest with funding to the sector growing at 34% CAGR during 2017–2021. Today, there are two unicorns: Digit Insurance and Policy Bazaar. The break-up of the industry is shown in Figure 1.

Figure 1. FinTechs and InsurTechs in India.

Source: India Brand Equity Foundation (www.ibef.org).

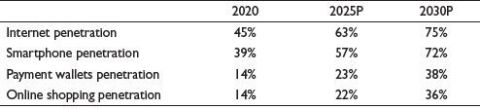

Source: RBI, Frost and Sullivan Analysis.

Increased Digital Adoption in Insurance and Evolution of Customer Behaviour

Insurance companies have improved their digital platforms by upgrading legacy systems and bringing in virtual assistants. LIC introduced LIC Mitra (a virtual assistant), New India Assurance launched the BIMA Bot, United India Insurance came out with UNI Help and National Insurance launched NYRA.

Favourable online consumer trends favouring the digital landscape and the insurance industry:

With this increased digital adoption, insurers like Acko have tied up with multiple platforms such as Ola cabs, Amazon, HDFC Bank, Cred, Zomato, Swiggy, MoneyTap, GoIbibo and so on for offering use-based insurance products to their customers/suppliers. Partnerships with InsurTechs are growing in rural areas too. Recently, for example, the Agriculture Insurance Company of India Limited (AICIL), a nationalised insurance company under the Ministry of Finance, Government of India, has signed a three-year agreement with Wingsure, an InsurTech company that is expected to use artificial intelligence and deep technology including advanced computer vision, augmented reality and voice capabilities to design new, specialised products for more than 40 million farmers in India and help them adapt to climate change and other livelihood related risks. Surely, these products would also have to be personalised and customised to meet individual needs of farmers which may span across the range of items used by them such as tractors, houses, cattle, crops, fertilisers, seeds and even business income. Many players like Amazon and Aviva Global Consulting are providing highly personalised and customised products to their clientele.

The demand for embedded, personalised and customised products offers tremendous innovation opportunities to insurers. Hence, insurers will have to place high emphasis both on:

Insurers, in India, may particularly leverage the scope of the following platforms/network to embed the highly personalised and the customised insurance products:

The ONDC platform is a unique concept enabling e-commerce through an open protocol based on open-source specifications. The ONDC is slowly gaining traction and sellers catering to the first-mile and last-mile delivery have particularly found it to be highly useful. Many smaller logistics players have also found a lifeline through this platform. All stakeholders registered on ONDC including sellers, buyers, borrowers from banks and logistics players would benefit from insurance services on the network. Since embedded services are a distinct consumer preference these days, sellers on ONDC could be permitted to embed logistics, financial and insurance services into their product offering.

GeM is the marketplace for all public procurement. All government institutions meet their requirements through this marketplace and hence all tenders are hosted on the GeM portal. However, there may be instances of the selected least cost supplier not adhering to the delivery timelines. Insurance may be a good option against any loss due to delays.

Agri Exchange, set up by the Agricultural and Processed Food Export Development Authority, Ministry of Commerce is an online trading portal and a single-window solution for all agricultural and processed foods exported from India. The portal provides rich statistics on domestic production and prices as well as international prices in different importing countries along with their import regulations. Embedding insurance for transportation to neighbouring countries in the region can help retain customers and increase exports and also promote financial inclusion in the country.

Conclusions

The expansion of micro-insurance or sachet insurance as embedded products rather than stand-alone products and customised and personalised as per preferences of the client will help promote financial inclusion in the country. The IRDAI has adopted the Regulatory Sandbox Approach to experiment and test innovative products in a safe and conducive environment. Sachet-embedded products in different environments can be safely tested using the Sandbox Approach.

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article

Aduda, J., & Kalunda, E. (2012). Financial inclusion and financial sector stability with reference to Kenya: A review of literature. Journal of Applied Finance and Banking, 2(6), 95.

Agarwal, S., Qian, W., & Tan, R. (2020). Financial inclusion and financial technology. In Household finance: A functional approach (pp. 307–346). Springer.

Al-Mudimigh, A., & Anshari, M. (2020). Financial technology and innovative financial inclusion. Financial technology and disruptive innovation in ASEAN (pp. 119–129). IGI Global.

Bansal, S. (2014). Perspective of technology in achieving financial inclusion in rural India. Procedia Economics and Finance, 11, 472–480. https://doi.org/10.1016/S2212-5671(14)00213-5

Barry, M. S., & Creti, A. (2020). Pay-as-you-go contracts for electricity access: Bridging the ‘last mile’ gap? A case study in Benin. Energy Economics, 90, 104843. https://doi.org/10.1016/j.eneco.2020.104843

Didenko, I. V., & Sidelnyk, K. (2021). Insurance innovations as a part of the financial inclusion. ARMG Publishing.

India Brand Equity Foundation. (6 October 2021). https://www.ibef.org/blogs/opportunity-for-fintech-in-the-indian-insurance-industry

Izaguirre, J. C., Lyman, T., McGuire, C., & Grace, D. (2016). Deposit insurance and digital financial inclusion. CGAP.

Litman, T. (2005). Pay-as-you-drive pricing and insurance regulatory objectives. Journal of Insurance Regulation, 23(3).

Muneeza, A., Arshad, N. A., & Arifin, A. T. (2018). The application of blockchain technology in crowdfunding: Towards financial inclusion via technology. International Journal of Management and Applied Research, 5(2), 82–98. https://doi.org/10.18646/2056.52.18-007

Ozili, P. K. (2022). Can central bank digital currency increase financial inclusion? Arguments for and against. SSRN Electronic Journal, 241–249. https://doi.org/10.2139/ssrn.3963041

Schuetz, S., & Venkatesh, V. (2020). Blockchain, adoption, and financial inclusion in India: Research opportunities. International Journal of Information Management, 52, 101936. https://doi.org/10.1016/j.ijinfomgt.2019.04.009

Singh, A. (2017).Role of technology in financial inclusion. International Journal of Business and General Management, 6(5), 1–6. https://www.finextra.com/blogposting/22246/how-embedded-finance-and-baas-are-transforming-india