1 Birla Institute of Technology and Science, Pilani, Rajasthan, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

The credit ratings play an important role in the allocation of capital among the enterprises, and thereby, in the growth of any economy. The different credit rating methodologies and criteria are used by different credit rating agencies, and the criteria may also differ from industry to industry. This research study tries to explore if it is possible to model credit ratings as the outcome of financial metrics. The study deploys the conjoint analysis approach to forecast the Ind-Ra ratings given to 50 firms, as a dependent variable and the key financial metrics as independent variables. First, the independent variables are computed based on financial statements. Then, the model is executed. It is found that the debt-equity ratio is negatively rated to credit rating, while the other three variables (profitability, asset turnover ratio and current ratio) are positively related to credit ratings. The study shows that financial metrics are not the only influencer of credit ratings but many subjective criteria such as future expected consumer trends, leadership overview, management aptitude and so on. Therefore, the model proposed in this study using financial statements has a 60% accuracy only because the subjective factors as mentioned above are difficult to be quantified and captured in the model as predictor variables.

Credit rating, credit risk, Ind-Ra Ratings, prediction model, conjoint analysis, credit worthiness, non-performing loans

Introduction

Banking sector plays an important role in the economic development of any country (Batten & Vo, 2019). It increases the investor sentiments and the investors’ invest in upcoming projects, leading the economy to grow (Luo et al., 2016). However, banks are also exposed to several risks such as credit risk, market risk, liquidity risk and so on. The credit risk is known to have the most significant effect on the bank’s profitability (Pesaran et al., 2006; Saleh & Afifa, 2020). That is why, most of the research on risk management in banks is focussed on credit risk (Chou & Buchdadi, 2016). Analysis of non-performing assets is very important in the assessment of the asset quality for banks (Meeker & Gray, 1987).

It is here that the credit rating agencies (CRAs) play an important role as an information intermediary between the banks and the bond issuers (Cantor & Packer, 1995; White, 2013). Credit ratings are an indication of the creditworthiness of a bond (Merriam-Webster, 2020). The credit assessment is also very important for the banks since many instances of banks becoming insolvent have been observed (Cole & White, 2017). The banks need to identify the non-performing loans promptly since the delayed recognition hampers the loan curing (Choudhary & Jain, 2021).

On the other hand, if one looks from the perspective of the corporate firms, it is very important for them also to get a good credit rating, since that lowers the perceived risk to the financers for investing in them, thereby, lowering the cost of capital for the firms (Delis et al., 2021). This conflict of interest may also incentivise them to furnish an optimistic picture to the CRAs. The businesses are also quite cautious about their credit rating to the extent that a few of them try to obtain multiple ratings to hedge against the downgrade risk (Chen & Wang, 2021; Huang et al., 2021).

Thus, it can be noticed that there exists a principal agency problem between the corporates and the CRAs. Therefore, the banks are also very much conscious about the performance of the firms that they have financed and have started monitoring the major decisions of a business, such as the decision related to the hiring of the CEOs (Marshall et al., 2014). Even the privatisation of banks in the recent past in the developed countries has also led to more competition in the sector and an improvement in the performance of the banking sector with the adoption of best practices (Otchere, 2009).

Such an improvement can partly be attributed to the adoption of data analytics, which holds significant potential for making the credit rating models faster and more efficient. Machine learning and big data technologies have also been used to predict the performance of credit risk (Kullaya Swamy & Sarojamma, 2020; Liu et al., 2022). Information contained in the credit derivatives is also being used today to predict the default risk of the corporates (Ye et al., 2022).

While some stress testing techniques have been developed to test the capital adequacy of the banks (Hale et al., 2020; Tente et al., 2019), it has not been explored in the literature if the credit ratings can be modelled on the financial metrics. The currently existing research literature on credit ratings mentions the frameworks that are used to validate probabilities of default credit rating models on a periodical basis using statistical tests (Schechtman, 2017). However, the association between the financial performance and the credit ratings has not been studied in a structured and scientific manner.

Since the financing business can also be considered to be the consumer choice model with the banks or financers purchasing the bonds of a firm, it was decided by the authors to use a conjoint analysis approach to establish the relationship between financial metrics and credit ratings. Currently, the applications of conjoint analysis as a consumer choice model have been limited to the field of marketing in the research literature. Therefore, the hypothesis to be tested is whether the conjoint analysis can be used to predict the credit ratings of the firms based on their financial metrics. In order to examine this hypothesis, this study intends to explore using the conjoint analysis approach can be used to predict the credit ratings on the basis of financial performance. If such models are developed, this can make the work of credit raters much automated. This study conducts exploratory data analysis on India Ratings and Research (Ind-Ra) ratings and the financials of the underlying firms using the quantile regression.

This research paper consists of seven sections that have been appropriately sequenced to give it a logical flow. The first section discusses the motivation behind the study, and the second section performs the literature review, identifying the need to explore the possibility of predicting the credit ratings with the help of financial ratios. The third section introduces the Ind-Ra ratings. The fourth section discusses the research methodology in detail, and the fifth section elaborates on the findings of the study. The sixth section sheds light on the implications of this study for managers. The seventh section concludes the article, mentioning the scope for future research.

Literature Review

It was in the middle of 19th century that the credit rates were coined as a symbol of creditworthiness (Rudden, 2015). Over time, their importance has been increasingly recognised with the onset of the financial recessions. However, we have also seen instances where the traditional credit rating mechanisms have failed to capture the risks, such as in the financial crisis of 2008 (Pertaia et al., 2021). Even in the COVID times, the non-performing loans have seen a spike in the global banking sector with the onset of the pandemic (Colak & Oztekin, 2021; Demirguc-Kunt et al., 2021; Nozawa & Qiu, 2021; Ozlem et al., 2021; Park & Shin, 2021; Yin et al., 2022).

The literature mentions many possible reasons for the mis-performance of credit raters. Some of these are misaligned incentives (Bar-Isaac & Shapiro, 2011; Luo et al., 2019), inadequate corporate governance (Berger et al., 2016; Fernando et al., 2020), the financial statement readability concerns (Hsieh, 2022), earnings management (Alissa et al., 2013; Baker et al., 2019; Zhang, 2018) and so on. Zhang and Schloetzer (2021) gave evidence that the longer tenure of management leads to lower quality of credit ratings. Authenticity and quality of the information provided to the CRAs have an important influence on the quality of credit ratings (Zhao, 2017).

Apart from the reasons mentioned above, the quality of the credit portfolio of lending institutions also gets influenced by the industry to which the borrower is affiliated. The business cycles also have a bearing on the non-performing assets for banks. The downturns in the business cycles also lead to a worsening of loan quality (Quagliariello, 2007). Besides this, Choudhary and Jain (2021) also mentioned the limitation of the banks that find the classification of non-performing loans to be an expensive process, and this is more so for the banks with lesser capital. As a result, the banks with lesser capital consider themselves at a disadvantage when it comes to use the services of credit raters.

According to the literature, the credit rating given to a firm would also depend on the soft factors such as managerial ability (Cornaggia et al., 2017), management risk (Pan et al., 2018) and the adequacy of corporate governance (Ashbaugh-Skaife et al., 2006). Kaur and Kaur (2011) assessed that all the rating agencies in India (CRISIL, ICRA, CARE and FITCH) use consistent rating methodologies.

This conflict of interest between credit raters and bond issuers has led to a situation where the issuer-pay model results in better credit ratings (Jiang et al., 2012), although the reputation concerns of the rating agencies try to discipline them (Mathis et al., 2009). Sometimes, a sudden change in the credit ratings may indicate a conflict of interest (Lee et al., 2021). The credit rater’s conflict of interest also varies with the business cycles, being more in the boom periods (Dilly & Mählmann, 2016). The credit ratings also depend on the overall developments in the sector to which the firm belongs (Kaniovski et al., 2016).

After the financial crisis of 2008, the world recognised the need for strict financial regulations (Adegbite, 2018). With the deregulation of banks in India, it has been observed that the negative association between profitability and non-performing loans has become even stronger (Ghosh et al., 2016). Banks have already been impacted by the tightening of credit supply and loan rates, as that has resulted in their enhanced cost of capital for them (Kovner & Van Tassel, 2021).

This calls for a more robust credit rating system that enables the banks and financial institutions to make judicious financing decisions. Therefore, some of the earlier research studies have called for establishing some criteria for credit union failure that can be used by institutional investors (Coen et al., 2019). CRAs also need to follow a transparent credit rating process in order to earn the trust of the clients (Rebryk et al., 2017).

The banking industry is undergoing disruption and adopting big data with the help of blockchain technology (Hassani et al., 2018). Analytics is being used for the prediction of default losses (Kellner et al., 2022). Sopitpongstorn et al. (2021) developed local logit regression to predict the loan recovery rate. Also, business sustainability is an important factor in credit rating (Cubas-Diaz & Sedano, 2018).

Although the conjoint analysis approach has been widely used for consumer choice modelling in marketing contexts, the same has not been used by the earlier studies in the context of predicting the credit ratings. Therefore, this study tries to explore the possibility of modelling the credit ratings of a firm, based on its financial metrics, using the conjoint analysis approach. This research study is thus, a novel and important extension to the existing body of literature on the prediction of credit ratings. The study examines the hypothesis of whether the credit ratings can be predicted using conjoint analysis based on the financial metrics.

About Ind-Ra Ratings

Ind-Ra Private Limited is a Fitch Group credit-rating firm that publishes ratings of Indian firms, and thus, acts as an information intermediary in the ecosystem of Indian capital markets. The other such layers that work in India are ICRA Limited, CRISIL, CARE, BWR, SMERA and so on.

The Securities and Exchange Board of India has, vide circular CIR/MIRSD/4/2011 dated 15 June 2011, standardised the rating symbols and their definitions for all CRAs in India. According to the said circular, Ind-Ra has revised its rating symbols and their definitions, which will be used for all outstanding issuer default ratings and outstanding instruments rated/assigned.

Research Methodology and Data Collection

This research study is based on the secondary data readily available for each corporate. The study develops a model to help streamline the process for Bank’s decision-making for credit lending to any new corporate and the allocation of its funds among the several firms, based on the parameters already used in the model.

The Seven-Step Process

Step 1: The financial ratios that can impact the credit rating of a firm according to the existing constructs were chosen.

Step 2: The data was collected on the firms rated by Ind-Ra ratings.

Step 3: The ranking of the corporates was done based on the cumulative value of credit rating and analyst recommendation, with priority to credit rating.

Step 4: The Ranking done in the Step 1 was converted into a score for the 102 firms, on a scale of 1–102, in such a way that the first ranked firm got the highest score of 102, and the lowest ranked firm got the lowest score of 1.

Step 5: The five continuous variables (the financial ratios selected in Step 1) were converted into categorical variables, and the coding logic for the conversion of continuous variables into categorical variables is shown in Table 2.

Step 6: The score derived in the Step 4 was modelled on the basis of categorical variables (created in Step 5) of market capitalisation value, debt-equity ratio, net profit margin, current ratio and asset turnover ratio using multiple linear regression.

Step 7: Based on the coefficients of various variables and their statistical significance, the influence and the relative importance of different variables on the model was determined.

Methodology for Step 1: Selecting the Financial Ratios

Most of the credit raters consider the financial ratios related to profitability, cashflow, debt-equity ratio, financial flexibility and so on. (CARE, 2018; CRISIL, 2020; Ind-Ra, 2019). Also, as the DuPont said that return on investment is dependent on profitability, asset productivity and leverage, these three financial ratios were considered in the study. Current ratio was included as the fourth variable to consider the cashflow aspect. Market capitalisation was selected as the fifth variable since it is directly related to the firm size, which is a significant factor in credit rating.

Methodology for Step 2: Sample and Data Collection

Sample firms were identified using Morgan Stanley Capital International’s Global Industry Classification Standard (GICS). GICS is a hierarchical four-tiered industry classification system comprised of 11 sectors, and for the study, the financial sector was excluded. The data was collected from the Refintiv Eikon (Thomson Reuters database) database.

Firms fulfilling the following four requirements were included in the sample. The first requirement was that the firm needs to be listed on BSE or NSE or both. The second requirement was that it should be followed by analysts and have analysts’ recommendations. Third, the firm should have an Ind-Ra long-term issuer rating. Fourth, the firm should have all the financial data available required for the study.

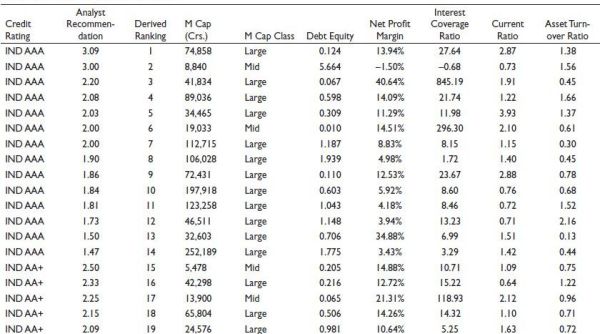

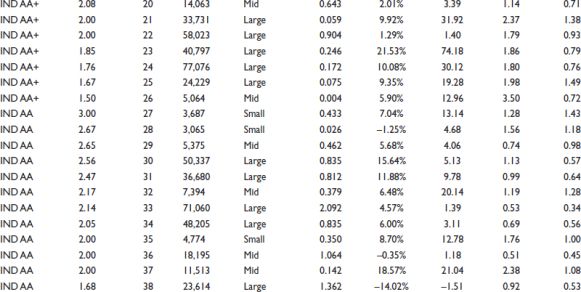

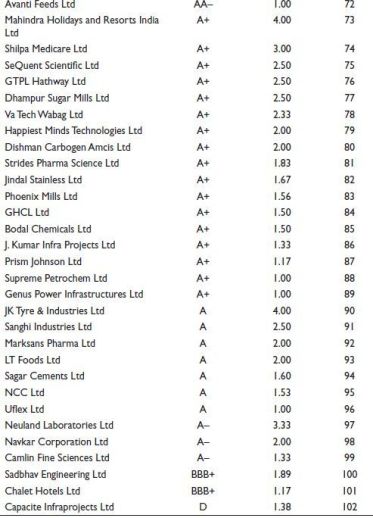

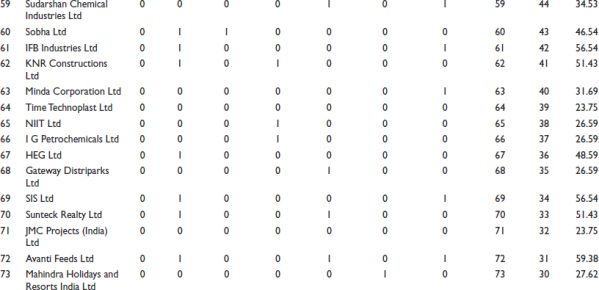

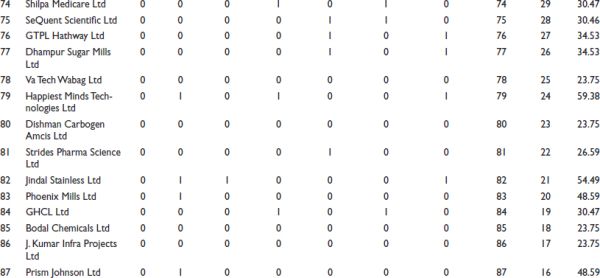

Based on the above criteria, 102 firms were included in the sample. The financial ratios of the 102 firms are shown in Table 1.

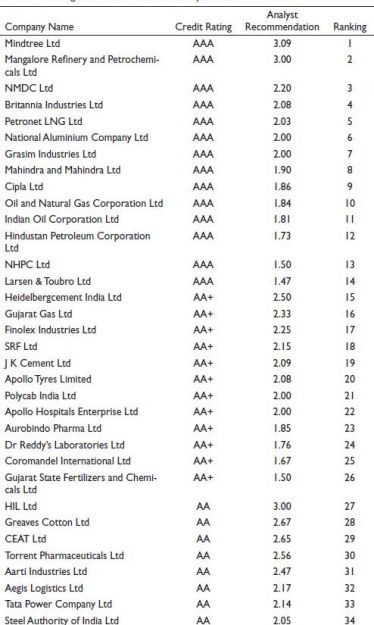

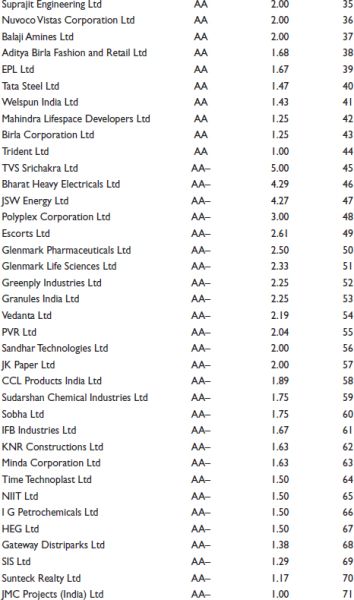

Methodology for Step 3: Ranking of the Firms Based on Credit Ratings Given by Ind-Ra

In Step 4, the firms whose credit ratings had been collected earlier were ranked based on analyst recommended scores as depicted in Table 2, with 1st rank denoting the most recommended firm.

Methodology for Step 4: Listing the Attributes and Defining the Attribute Levels

Based on the existing theoretical construct of the factors influencing the credit rating, the five attributes were listed down as market capitalisation, debt-equity ratio, net profit margin, current ratio and asset turnover ratio. Then, the levels were decided within each of these attributes to categorise the firms as shown in Table 3.

Table 1. Financial Metrics of the 102 Firms.

Source: Ind-Ra Ratings report (2022).

Table 2. Rankings of the Firms Based on Analyst Recommendations.

Source: Authors based on Recommendations in Ind-Ra Ratings Report (2022).

Table 3. The Attributes and Attribute Levels for Classification of the Firms.

Source: Ind-Ra Ratings report (2022).

Note: Using the concept of combinations, there can be 3 × 2 × 3 × 2 × 2 = 72 total combinations of attribute levels.

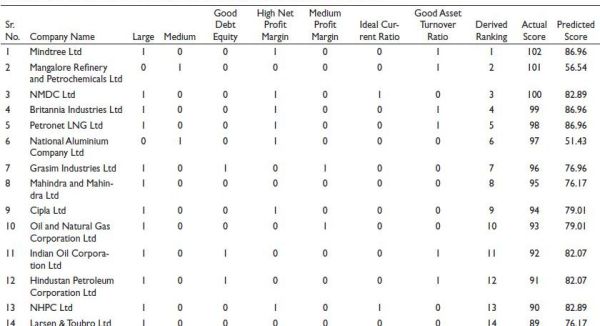

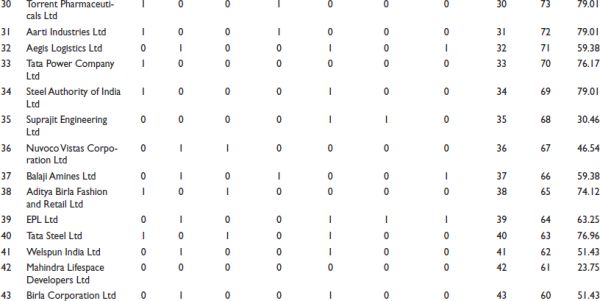

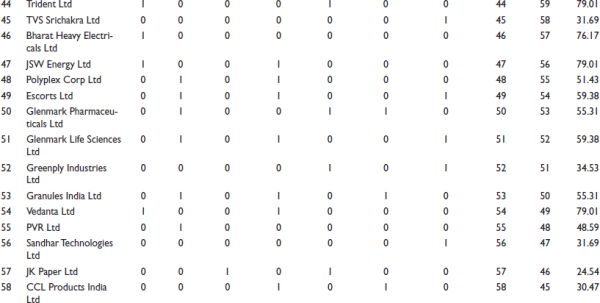

Methodology for Step 5: Encoding of Categorical Binary Independent Variables and Performing the Regression Model

In this step, each one of the product attribute levels was converted into a binary independent variable for each attribute level, and then, the regression model was run between the independent variables and the rank of the rated firm as the dependent variable. In this regression model, the binary independent variable corresponding to one of the attribute levels within each attribute was omitted to avoid multi-collinearity issues. The categorical variables corresponding to one attribute level within each attribute were removed from the model as reflected in Table 4.

After encoding, the regression was performed with the company score as the dependent variable and the attribute levels as the independent variables. For this purpose, the ranks of the firms were converted into scores, with the rank 1 getting the highest score and vice versa.

Table 4. The Binary Independent Variables that were Part of the Regression Model.

The Findings of the Study

Table 5 shows the score for each firm given on the basis of the rank and the predicted score as per the model.

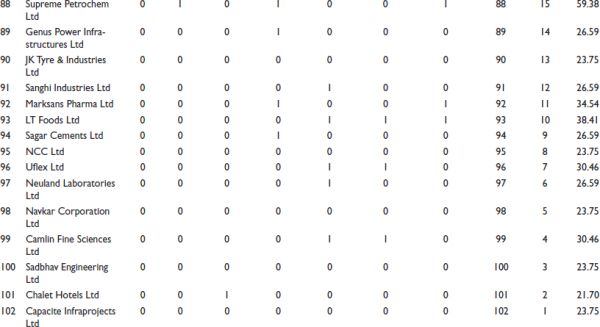

The output of the regression model is shown here in Table 6. It can be observed that the model has a reasonable explanation of the variations in the credit ratings across the firms.

It is clear from the ANOVA table in Table 7 that the variations in the analyst recommendations are significantly explained by the model. Since the p values for the three variables are significant at a 90% confidence level, it can be said that market capitalisation and asset turnover ratio are two robust predictors of the credit rating of a firm, with the higher market capitalisation firms and higher asset turnover ratios forms enjoying better analyst recommendations.

After this, the range of coefficients of attribute levels was computed as ‘maximum coefficient of any attribute level in that attribute–minimum coefficient of any attribute level in that attribute’. These ranges of coefficients for each attribute are shown in Table 7.

The higher the range of the coefficients of the attribute levels within each attribute, the more the discriminating influence of that attribute in the model. So, it can be concluded that among the parameters, ‘market cap’ is considered the most and the sequence of consideration is—market cap > asset turnover ratio > current ratio > net profit margin > debt equity.

From the p values of the coefficients also, it can be observed that the influence of market capitalisation and asset turnover is statistically significant at 90% confidence. This corroborates the insights drawn earlier from the range of coefficients.

From the signs of the coefficients of the predictor variables in the regression, it can also be inferred that the four financial metrics—profitability, asset turnover ratio, market capitalisation and ideal current ratio—have a positive impact on the credit rating, while the debt-equity ratio has a negative influence. From the coefficients of the regression model, one can observe that the large-cap firms enjoy better ratings than the midcap, and the midcap enjoy better than the small-cap. Second, the more profitable the firms, the better their credit rating.

Table 5. Input Data for Regression Model after Adjusting Preference Along with Observations.

Figure 1. A Screenshot of the Predicted Score vs the Actual Score as per the Model.

.jpg/10_1177_jiift_231225913-fig1(1)__800x224.jpg)

One of the possible reasons behind the lowest consideration to the debt-equity ratio by the proposed prediction model can be the fact that the banks want the businesses to take more debt as long as it is invested into productive assets that can generate more returns. Therefore, sometimes, the firms with large debt-equity ratio may enjoy a good rating. Also, as long as a firm generates a good return on the debt, the banks are not concerned with a large debt on the books.

Figure 1 shows the actual score and the predicted score by this model for each firm. It can be observed that the model has been able to predict with an overall accuracy of 65%–70%. The adjusted R-square is ~53%. This can be because of the fact that the subjective factors, such as leadership team, business model, environmental and regulatory factors, competitor forces and so on, have not been considered in this model, while these are also important factors in credit rating.

Managerial Insights

One of the primary concerns while lending is the assessment of the payee to whom the loan is disbursed. However, the financial sector seems to be filled with uncertainties regarding the performance of loans and the creation of non-performance assets, but the statistical assessment of data sets gives a way forward. If some models can be developed to predict the rating of a firm faster based on certain characteristics, then the work of CRAs can be much faster, and the businesses, themselves, can find out their credit ratings, thereby reducing the information asymmetry which exists in today’s context.

Therefore, the primary objective of this study is to develop a model which may predict the credit-worthiness of an institutional client considering key financial indicators such as current ratio, liquidity ratios, asset/ turnover, profitability ratios, etc., and Industry benchmarks such as companies with very good credit ratings and average credit ratings. The analysis was done for companies that are public as their data were available in the public domain. After analysing their financials and removing the dummy or insignificant variables, financial metrics related to these five variables were measured—Market capitalisation, debt-equity ratio, net profit margin, current ratio and asset turnover ratio. The model developed in this study achieved a moderate prediction accuracy of 70%, and the R-squared value was also found to be slightly greater than 0.5, implying that this model is able to explain fifty percent of the variance in the credit ratings. This is quite close to the expected numbers since the subjective factors that influence the credit ratings have not been considered in this model.

Table 6. The Regression Metrics of the Model.

Table 7. Range of the Coefficients of Attribute Levels for Each Attribute.

.jpg/10_1177_jiift_231225913-table7(2)__480x294.jpg)

Upon further analysis, it revealed that the model predicts the large-cap companies to be better performers and are considered good to disburse loans rather than mid-cap. Similarly, the more profitable companies and the firms that can utilise their assets more productively were given a better score by the model. The firms which have taken more debt in their capital structure scored lower in general. This is in line with the prevailing theoretical construct that debt increases the financial leverage and therefore, the credit risk of the firm. The businesses that maintain the ideal current ratio were also rated higher by the model because of the ability of these firms to manage the business operations with lower working capital.

However, considering the p values of the coefficients in the model and the range of coefficients for different attribute levels within each attribute, one finds that the current ratio, debt ratio and profitability ratio have a lower influence on the credit rating as compared to market capitalisation and asset turnover ratio. This is because the shareholders and the entire financing ecosystem put more emphasis on wealth maximisation and not profit maximisation. Also, wealth maximisation is more dependent on the investing decisions, of which the asset turnover ratio is a proxy.

The values of the credit scores predicted by this model were slightly more conservative than the actual score of companies, and it can be safely deduced that the model developed is safe and realistic for predicting credit-worthiness scores.

It has also been seen that non-performing loans are less responsive to macroeconomic factors (Louzis et al., 2012). The earlier research studies have also advocated the tendency to default on loan payments increases with the degree of cyclical pattern in the firm’s business (Jensen et al., 2017). So, the businesses that have very low cyclicity can be given less attention to, while the ones with high cyclicity should be evaluated more thoroughly.

Conclusions

This is the first article that tried to model credit ratings based on financial metrics. The purpose of the article was more about exploring the possibility of predicting the credit rating from the financial performance. The model developed in the article can be said to be a fair indicator in this direction. Also, it was not expected to have a strong predictive power since the prospective returns on the existing assets are not only determined by the historical patterns of financial performance but also by the subjective elements of evaluation such as leadership structure, business strategy, organisational culture, innovation, sectoral developments, regulatory perspective, future disruptions and so on, which have not been considered while modelling.

One of the limitations of this study is that it has not incorporated the soft elements of the business. The second limitation is that the financial metrics also change with time and with the business cycles. If the average financial metrics are taken as averages of a longer time horizon, then that can be better. However, there is also a risk of giving lower weightage to the latest developments if one takes the averages over too large a period.

There are many extensions of this research study in the future. First, this study can be made more exhaustive by incorporating the non-financial metrics of the business, such as cost of customer acquisition and retention, facility location dynamics, bargaining power with the suppliers and other stakeholders and so on. Second, the futuristic elements, such as technological acceptance, supply chain resilience, business sustainability, digital friendliness, perceived human resource friendliness, customer loyalty and advocacy, leadership pedigree, functional strategies and so on, are more reflective of the future business strategies. Third, the credit rating models can also be developed for the ratings provided by other CRAs such as ICRA, Moody’s S&P and so on.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

ORCID iD

Gaurav Nagpal  https://orcid.org/0000-0003-1957-7865

https://orcid.org/0000-0003-1957-7865

Adegbite, G. (2018). 2008 Global financial crisis-ten years after; is another crisis ‘resonating’? SSRN.

Alissa, W., Bonsall, S. B., Koharki, K. & Penn, M.W. (2013). Firms’ use of accounting discretion to influence their credit ratings. Journal of Accounting and Economics, 55(2–3), 129–147.

Ashbaugh-Skaife, H., Collins, D. W., & LaFond, R. (2006). The effects of corporate governance on firms’ credit ratings. Journal of Accounting and Economics, 42(1–2),:203–243.

Baker, T. A., Lopez, T. J., Reitenga, A. L. & Ruch, G.W. (2019). The influence of CEO and CFO power on accruals and real earnings management. Review of Quantitative Finance and Accounting, 52(1),325–345.

Bar-Isaac, H. & Shapiro, J. (2011). Credit ratings accuracy and analyst incentives. American Economic Review, 101(3), 120–124.

Batten, J., & Vo, X. V. (2019). Determinants of bank profitability—Evidence from Vietnam. Emerging Markets Finance & Trade, 55(1), 1417–1428. https://doi.org/10.1080/1540496X.2018.1524326

Berger, A. N., Imbierowicz, B. & Rauch, C. (2016). The roles of corporate governance in bank failures during the recent financial crisis. Journal of Money, Credit and Banking, 48(4), 729–770.

Cantor, R. & Packer, F. (1995). The credit rating industry. Journal of Fixed Income, 5(3), 10–34.

CARE. (2018). CARE’s credit rating process. https://www.careratings.com/pdf/resources/CARE'sCreditRatingProcess24May2019.pdf

Chen, Z. & Wang, Z. (2021). Do firms obtain multiple ratings to hedge against downgrade risk? Journal of Banking and Finance, 123, 106006.

Chou, T. K., & Buchdadi, A. D. (2016). Bank performance and its underlying factors: A study of rural banks in Indonesia. Accounting and Finance Research, 5(3), 79–91. https://doi.org/doi:10.5430/afr.v5n3p55

Choudhary, M. A. & Jain, A.K. (2021). Corporate stress and bank nonperforming loans: Evidence from Pakistan. Journal of Banking and Finance, 133,106234.

Coen, J., Francis, W. B. & Rostom, M. (2019). The determinants of credit union failure: Insights from the United Kingdom. International Journal of Central Banking, 15(4), 207–240.

Colak, G. & Oztekin, Ö. (2021). The impact of COVID-19 pandemic on bank lending around the world. Journal of Banking and Finance, 133, 106207.

Cole, R. A. & White, L.J. (2017). When time is not on our side: The costs of regulatory forbearance in the closure of insolvent banks. Journal of Banking and Finance, 80, 235–249

Cornaggia, K. J., Krishnan, G. V. & Wang, C. (2017). Managerial ability and credit ratings. Contemporary Accounting Research, 34(4), 2094–2122.

CRISIL. (2020). CRISIL’s approach to financial ratios. https://www.crisil.com/mnt/winshare/Ratings/SectorMethodology/MethodologyDocs/criteria/CRISILs%20Approach%20to%

Cubas-Diaz, M., & Sedano, M. A. M. (2018). Do credit ratings take into account the sustainability performance of companies? Sustainability, 10(11), 1–24. https://doi.org/10.3390/su10114272

Delis, M. D., Kim, S. -J., Politsidis, P. N., & Wu, E. (2021). Regulators vs markets: Are lending terms influenced by different perceptions of bank risk? Journal of Banking and Finance, 122, 105990.

Demirguc-Kunt, A., Pedraza, A. & Ruiz-Ortega, C. (2021). Banking sector performance during the COVID-19 crisis. Journal of Banking and Finance, 133, 106305.

Dilly, M. & Mählmann, T. (2016). Is there a boom bias in agency ratings? Review of Finance, 20(3), 979–1011. https://doi.org/10.1093/rof/rfv023

Fernando, J. M. R., Li, L. & Hou, Y. (2020). Corporate governance and correlation in corporate defaults. Corporate Governance: An International Review, 28(3), 188–206.

Ghosh, C., Hilliard, J., Petrova, M. & Phani, B.V. (2016). Economic consequences of deregulation: Evidence from the removal of the voting cap in Indian banks. Journal of Banking and Finance, 72, S19–S38.

Hale, G., Krainer, J. & McCarthy, E. (2020). Aggregation level in stress-testing models. International Journal of Central Banking, 16(4), 1–46.

Hassani, H., Huang, X., & Silva, E. (2018). Banking with blockchain-ed big data. Journal of Management Analytics, 5(4), 256–275.

Hsieh, Y. T. (2022). Financial statement readability and credit rating conservatism. Journal of Corporate Accounting and Finance, 33(1), 145–163.

Huang, H., Svec, J. & Wu, E. (2021). The game-changer: Regulatory reform and multiple credit ratings. Journal of Banking and Finance, 133, 106279.

Ind-Ra. (2019). Corporate rating methodology: Master criteria. https://www.indiaratings.co.in/Uploads/CriteriaReport/CorporateRatingMethodology.pdf

Jensen, T. L., Lando, D. & Medhat, M. (2017). Cyclicality and firm size in private firm defaults. International Journal of Central Banking, 13(4), 97–145.

Jiang, J. X., Harris Stanford, M. & Xie, Y. (2012). Does it matter who pays for bond ratings? Historical evidence. Journal of Financial Economics, 105(3), 607–621.

Kaniovski, Y. M., Boreiko, D. V., & Pflug, G. C. (2016). Numerical modeling of dependent credit rating transitions with asynchronously moving industries. Computational Economics, 49(3), 499–516. https://doi.org/10.1007/s10614-016-9576-1

Kaur, K., & Kaur, R. (2011). Credit rating in India: A study of rating methodology of rating agencies. Global Journal of Management and Business Research, 11(12), 63–68.

Kellner, R., Nagl, M. & Rösch, D. (2022). Opening the black box - Quantile neural networks for loss given default prediction. Journal of Banking and Finance, 134, 106334.

Kovner, A. & Van Tassel, P. (2021). Evaluating regulatory reform: Banks’ cost of capital and lending. Journal of Money, Credit, and Banking, 54(5), 1313–1367.

Kullaya Swamy, A. & Sarojamma, B. (2020). Bank transaction data modeling by optimized hybrid machine learning merged with ARIMA. Journal of Management Analytics, 7(4), 624–648.

Lee, W. C., Shen, J., Cheong, T. S., & Wojewodzki, M. (2021). Detecting conflicts of interest in credit rating changes: A distribution dynamics approach. Financial Innovation, 7(1), 1–23.

Liu, J., Zhang, S. & Fan, H. (2022). A two-stage hybrid credit risk prediction model based on XGBoost and graph-based deep neural network. Expert Systems with Applications, 195, 116624.

Louzis, D. P., Vouldis, A. T. & Metaxas, V.L. (2012). Macroeconomic and bank-specific determinants of non-performing loans in Greece: A comparative study of mortgage, business, and consumer loan portfolios. Journal of Banking and Finance, 36(4), 1012–1027.

Luo, R., Fang, H., Liu, J., & Zhao, S. (2019). Maturity mismatch and incentives: Evidence from bank-issued wealth management products in China. Journal of Banking and Finance, 107, 105615.

Luo, Y., Tanna, S. & De Vita, G. (2016). Financial openness, risk and bank efficiency: Cross-country evidence. Journal of Financial Stability, 24(3), 32–148. https://doi.org/10.1016/j.jfs.2016.05.003

Marshall, A., McCann, L. & McColgan, P. (2014). Do banks really monitor? Evidence from CEO succession decisions. Journal of Banking and Finance, 46(1), 118–131.

Mathis, J., McAndrews, J. & Rochet, J.-C. (2009). Rating the raters : Are reputation concerns powerful enough to discipline rating agencies? Journal of Monetary Economics, 56(5), 657–674.

Meeker, L. G. & Gray, L. (1987). A note on non-performing loans as an indicator of asset quality. Journal of Banking and Finance, 11(1), 161–168.

Merriam-Webster. (2020, April 24). Credit rating. https://www.merriam-webster.com/dictionary/credit%20rating

Nozawa, Y. & Qiu, Y. (2021). Corporate bond market reactions to quantitative easing during the COVID-19 pandemic. Journal of Banking and Finance, 133, 106153.

Otchere, I. (2009). Competitive and value effects of bank privatization in developed countries. Journal of Banking and Finance, 33(12), 2373–2385.

Ozlem Dursun-de Neef, H. & Schandlbauer, A. (2021). COVID-19 and lending responses of European banks. Journal of Banking and Finance, 133, 106236.

Pan, Y., Wang, T. Y. & Weisbach, M.S. (2018). How management risk affects corporate debt. Review of Financial Studies, 31(9), 3491–3531.

Park, C. Y. & Shin, K. (2021). COVID-19, nonperforming loans, and cross-border bank lending. Journal of Banking and Finance, 133, 106233.

Pertaia, G., Prokhorov, A. & Uryasev, S. (2021). A new approach to credit ratings. Journal of Banking and Finance, 140, 106097

Pesaran, M. H., Schuermann, T., Treutler, B. -J. & Weiner, S.M. (2006). Macroeconomic dynamics and credit risk: A global perspective. Journal of Money, Credit and Banking, 38(5), 1211–1261.

Quagliariello, M. (2007). Banks’ riskiness over the business cycle: A panel analysis on Italian intermediaries. Applied Financial Economics, 17(2), 119–138.

Rebryk, M., Rebryk, Y., Sokol, S., & Kozmenko, Y. (2017). The potential of conflicts of interest arising in the activities of credit rating agencies in Ukraine. Problems and Perspectives in Management, 15(2), 222–233. https://doi.org/10.21511/ppm.15(2-1).2017.06

Rudden, R. (2015). Evolution of credit ratings. Caribbean Information and Credit Rating Service Limited.

Saleh, I., & Afifa, M. A. (2020). The effect of credit risk, liquidity risk and bank capital on bank profitability: Evidence from an emerging market. Cogent Economics & Finance, 8(1), 1–14. DOI: 10.1080/23322039.2020.1814509

Schechtman, R. (2017). Joint validation of credit rating PDs under default correlation. International Journal of Central Banking, 13(2), 235–282.

Sopitpongstorn, N., Silvapulle, P., Gao, J. & Fenech, J.-P. (2021). Local logit regression for loan recovery rate. Journal of Banking and Finance, 126, 106093.

Tente, N., Westernhagen, N. V., & Slopek, U. (2019). M-PRESS-CreditRisk: Microprudential and macroprudential capital requirements for credit risk under systemic stress. Journal of Money, Credit and sBanking, 51(7), 1923–1961.

White, L. (2013). Credit rating agencies: An overview. Annual Review of Financial Economics, 93–122.

Ye, X., Yu, F. & Zhao, R. (2022). Credit derivatives and corporate default prediction. Journal of Banking and Finance, 138, 106418.

Yin, J., Han, B. & Wong, H.Y. (2022). COVID-19 and credit risk: A long memory perspective. Insurance: Mathematics and Economics, 104, 15–34.

Zhang, E. X., & Schloetzer, J. D. (2021). Management tenure and the quality of corporate bond ratings. Journal of Management Accounting Research, 33(3), 213–235.

Zhang, X. E. (2018). Do firms manage their credit ratings? Evidence from rating-based contracts. Accounting Horizons, 32(4), 163–183.

Zhao, Q. (2017). Do managers manipulate earnings to influence credit rating agencies’ decisions? Evidence from watchlist. Review of Accounting and Finance, 16(3), 366–384. https://doi.org/10.1108/RAF-05-2016-0078