1Integrated Policy and Analysis Division, The Energy and Resources Institute (TERI), New Delhi, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed

The manufacturing sector in India has increasingly grown over the period of last 20 years. Various factors like interest rate, inflation, government interventions, technology and finance affect the growth of a sector; but this article focuses on foreign direct investment outflow (FDI outflow), consumer price index (CPI) and real effective exchange rate (REER) to assess the impact of these factors on the growth of manufacturing sector of India in particular. This study employs a cointegration model and vector error correction model to analyse the impact and also the Granger causality test to determine causality between them over a time period of 20 years, which is from 2000 to 2019. The results indicate second-order cointegration and no short-run relationship among the variables, whereas there is existence of a long-run relationship. The findings of the article affirm the idea that FDI outflow has the potential to contribute to the growth of the manufacturing sector in India. Also, through proper management of REER and control of CPI, the impact of FDI outflow on the manufacturing sector growth can further be augmented.

Foreign direct investment, consumer price index, manufacturing sector, growth, real effective exchange rate, cointegration, vector error correction model

Introduction

The manufacturing sector has been a core sector for the growth of any economy. Indian government has been relaxing and introducing policies like ‘Make in India’ to channelise investments into the country to make it one of the fastest growing sectors of the Indian economy. The government back in 1990s knew in order to attain the peak of growth, there is a need to induce investments from abroad due to which the reforms in economy were made through liberalisation, privatisation and globalisation with a larger aim to erode poverty and create more employment opportunities for citizens by expanding the economy, especially manufacturing sector.

Recently, the government has eased the rules of foreign exchange management act and the measures like PM Gati Shakti have been taken to increase investments in India. The government even approved production linked incentive (PLI) scheme for auto industry and drone industry to boost manufacturing sector capacity. In only the first half of FY 2021, India received foreign direct investment (FDI) investments of US$ 30 billion, which is 15% more than the previous year in the same period.1 Although the service sector receives the maximum investments followed by the automobile sector, the government is promoting FDI in the manufacturing sector to emerge as a global manufacturing hub.

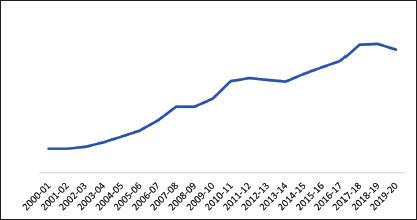

As seen in Figure 1, the manufacturing sector has witnessed a continuous growth since 2000 except in 2012–2014. According to the Department for Promotion of Industry and Internal Trade, FDI equity inflow in India stood at US$ 572.81 billion between April 2000 and December 2021, indicating that the government’s efforts to improve ease of doing business and relaxing FDI norms have yielded results. However, India’s outward FDI has also increased since liberalisation, and the country is heavily investing in developing countries of the south to promote south–south cooperation. As per the Ministry of Economic Affairs, GOI; countries such as Singapore, Netherlands and USA receive maximum investments from India.

Figure 1. Trend of Growth in Manufacturing Sector from 2000–2020 in Million USD.

Source: World Bank.

Several of the studies such as Bano and Tabbada (2015), Devajit (2012) and Srikanth and Kishore (2012) have been conducted in the past that look at the impact of inflow of FDI. However, the focus of study is now increasingly shifting to finding the determinants and impact of outflow of FDI on economy of the host nation through quantitative analysis. Studies such as Imbriani et al. (2011), Nayyar and Mukherjee (2020) and Thomas and Narayanan (2017) have significantly contributed to this matter of study using panel data, difference in difference estimator, etc. However, their concern largely remains on finding the determinants of outward FDI and the relation between exports and outward FDI. Also, the studies conducted in the past have looked at a few specific developed and developing economies. It is in this context that there is a need to further expand the area and scope of the study; hence, this study is undertaken to focus on the impact of outward FDI on the manufacturing sector of the Indian economy, which is relevant and necessary due to the shift in the government policies to build India as a manufacturing hub.

Investments across the nations is one among many reasons which affect the growth of this sector. Among different factors, the exchange rate also affects the growth of this sector by influencing the trade patterns among nations. Consumer price index (CPI) as a proxy of cost/ inflationary conditions in the markets to which most of India’s exports are directed also affects the growth of a nation.

FDI, real effective exchange rate (REER) and CPI are three significant parameters that serve as a vehicle for economic development and this research paper will empirically explore the influence of these parameters on the growth of the manufacturing sector in the case of the Indian economy.

The organisation of the study is as follows. The first section introduces the subject and the importance of the variables for the larger economic development and the second section introduces the literature review. The third section introduces the objectives and research questions of the study. The fourth section introduces the methodology adopted to conduct the research, the fifth section will discuss the analysis and its results, followed by the conclusion.

Literature Review

World today is characterised by global interconnectedness and dependence. Globalisation has brought together national and regional economies under one global economy, which has further opened prospects for growth and dynamic development (Surugiu & Surugiu, 2015). To realise this potential, governments around the world have deregulated trade and financial markets, which has resulted in extensive flows of goods and services among countries.

However, due to the growing complexities in the trade relations among the nations, the countries started to invest in other countries apart from importing and exporting. Eaton and Tamura (1994) found that FDI is induced by exports. However, Grosse and Trevino (1996) argue that exports are induced and established by FDI. It is well-proclaimed that foreign investments are crucial to the growth of any economy as they increase production capacity, enhance job opportunities and hence bring growth to the recipient nation (Banga, 2004). Devajit (2012) in his study says that FDI is seen as an important catalyst of economic growth in India since it induces domestic investment and facilitates the import of technology. Srikanth and Kishore (2012) suggest that Indian policymakers should be encouraged to make policies conducive to attract huge FDI into the country because it increases industrial production. In this regard, emerging nations like India have even reformed their investment policies to attract more stable forms of foreign capital (Nanda et al., 2020). This shows that the general notion that FDI inflows play an important role in the economic growth of recipient country is supported widely.

While there is a significant literature that supports this idea, there is another argument put forth by researchers that even outward FDI allows countries to expand their operations in foreign countries, bring technological know-how and in turn achieve domestic economic growth. Joseph (2019) in his study mentions outward FDI has benefitted the manufacturing sector in India through easy access to natural resources. Sahoo and Bishnoi (2021) in their paper found that in the case of India, domestic investments are positively affected by outward FDI and it confirms its positive effect on economic growth. Bano and Tabbada (2015) found that FDI outflows are positively linked with high gross domestic product (GDP), foreign reserves, domestic savings and even on FDI inflows in the host nations, however, the necessity of each factor is found varying with development. Banga (2008) in her paper, looks at the drivers that induce outward FDI from Asian developing countries and they found that increasing competition by imports in domestic markets and bilateral investment agreements have facilitated the outward investment. Also, it was found that the capability to make outward investments improve with higher investment inflows and rising imports of technology. Costly labour and poor infrastructure have been marked as important domestic drivers of outward FDI from Asian developing countries.

Imbriani et al. (2011) in their paper analyse if outward FDI has any significant impact on job creation and productivity in the donor country and also if the impact of FDI outflow differs among different sectors like manufacturing and services in Italy employing difference-in-difference estimator. The results show that while considering the manufacturing sector, outflow of FDI is seen to have strengthened productivity and job market, however, in the service sector, a negative effect is seen on jobs; but only after 2 years of investment. Particularly, in Indian context, Pradhan (2017) reveals that outward FDI tends to enlarge market access and further contributes to technological upgrading through the acquisition of strategic assets or overseas research and development (R&D). On the flip side, Tolentino (2010) in his paper suggest the level of outward FDI do not Granger cause home country-specific macroeconomic factors neither in China nor India.

Several others like Thomas and Narayanan (2017) in their paper find the determinants of outward FDI with reference to Indian manufacturing firms using dynamic random-effects models and the results showed a significant impact of exports–imports of technology, R&D intensity on the outward FDI of firms. It also revealed a complementary relationship between outward FDI (OFDI) and exports by Indian firms. Yang et al. (2013) in their paper use panel data to investigate the impact of OFDI on the technical efficiency of the OFDI firms, and the study suggests a positive relation between them. Likewise, Nayyar and Mukherjee (2020) suggest the government should increase its efforts on sharing of knowledge and technology to induce the flow of FDI. The paper indicated the existence of long-run relationship among the explanatory variable, that is, FDI and dependent variable, that is, macroeconomic policies in the host nation. Contrarily, Bhasin and Kapoor (2019) in their paper say that FDI outflow negatively impacts the exports in the donor country, and also there is no long-run relationship among the variables.

The impact of outward FDI is perhaps also influenced by the type of economy investment is made into and in this regard, study by Liu et al. (2015) explores how the outward FDI by manufacturing firms in Taiwan affects their job market, domestic productivity, and it was found that outward FDI from Taiwan to high-wage countries has a positive impact on these variables, that is, productivity and employment generation.

Substantial studies have been carried out specifically to find out the possible determinants of growth. Majority of the studies concluded that possible determinants of growth are FDI, market size, trade openness, exchange rate, CPI, etc., and the influence of exchange rate on growth has increased post-deregulation of the economy. Drawing from history, competitive and stable exchange rates are taken as crucial indicators for industrialisation. Koirala (2018) in his paper examines if REER has any impact on growth in Nepal. The Engle-Granger cointegration test and error correction model have been employed in the study using independent variables such as REER, money supply, trade, and capital formation and dependent variable is the GDP of Nepal. The results of the study reveal that there is a positive and significant relationship among the variables.

Vorlak et al. (2019) in their research paper examine the impact of exchange rate on the growth of Cambodia which is measured through GDP. The study used somewhat similar explanatory variables such as exchange rate, money supply, trade, inflation and FDI. Using ordinary least squares regression model, it was found that except trade openness all other factors have a positive correlation with GDP. Likewise, there is a study conducted by Kogid et al. (2012), which attempts to examine the impact of the exchange rate on growth in Malaysia using time series. Through the auto-regressive distributed lag (ARDL) test, it is suggested that there exists long-run cointegration between exchange rate and economic growth. Meanwhile, Korkmaz (2013) in her paper found that foreign exchange is perhaps also impacted by political factors besides economic factors like inflation or unemployment.

Another major determinant of growth is CPI, which measures the average price changes in goods and services purchased by consumers over a period. It is generally denoted as a proxy of inflation and to general understanding, we know that a high level of inflation negatively affects the GDP of a country. Aboobucker and Jahufer (2018) in their paper look at the impact of CPI and gross domestic savings on the GDP of Sri Lanka and their results show that there exists a long-run causality significantly from economic growth to CPI. Also, Gumbe and Kaseke (2009) in their paper found that CPI negatively impacts productivity and job opportunities and in turn negatively affects the manufacturing output.

Through the literature considered, it is clear that the impact of FDI on the economy is a major area of discussion and study. However, in view of the uncertainty and the contrasting opinions about role and impact of FDI, this present study is undertaken with the aim to contribute to the mainstream literature by investigating the impact of FDI outflow and other necessary/controlling factors in the case of India. Also, as seen the economic landscape is changing significantly, hence, there emerges a need to re-examine these relationships in the case of emerging economies (Sahoo & Bishnoi, 2021). Thereby, this study tries to look at the relationship between outward FDI and the growth of the manufacturing sector in particular and to explain this relationship, three sets of explanatory factors are considered as follows: (1) FDI outflow; (2) exchange rate and (3) CPI.

In the following section, research questions and hypothesis are framed and the methodology adopted to carry the analysis is illustrated.

Objective and Research Questions

The general objective of this study is to find out the relationship between manufacturing sector growth and the different identified macroeconomic variables, while the specific objectives are as follows:

Framing Hypothesis

H1: Value added of the manufacturing sector is positively affected by FDI outflow.

H2: CPI will negatively influence the manufacturing sector’s value added.

H3: REER will have a positive influence on the value added of the manufacturing sector.

Methodology

The article analysed the time series data of India for the period 2000–2019 to measure the impact of FDI Outflow on the growth of the manufacturing sector. The article has also identified the impact of other controlled variables on the value added of the manufacturing sector through the literature review and the analysis, that is, REER and CPI. The efficiency of the model is checked through the normality of the variables and stationarity test of the time series data. Then, the cointegration test is applied to observe the existence of either a short-run or long-run relationship in the time series variables. After conducted cointegration test only, decision is made on using the vector error correction model (VECM) model. Last but not least, the Granger causality test is performed to examine the causality of the variables used in this article.

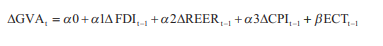

To examine how net FDI outflows, REER, CPI from the years 2000–2020 affect the value added to the manufacturing sector in India, the model below is used:

GVAt = α0 + α1FDIt–1 + α2REERt–1 + α3CPIt–1

where GVA: gross value added to the manufacturing sector

FDI: foreign direct investment outflows

REER: real effective exchange rate

CPI: consumer price index

However, if there is non-stationarity/unit root presence and also cointegration in the variables of our model, then we will take the course to usage of VECM in order to capture the long-run relationship between variables. The model then used will be as follows:

Data Source

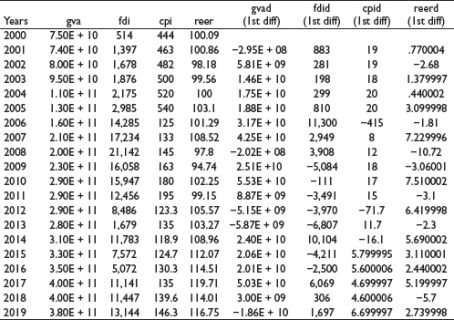

The data are collected for the period 2000–2019. The data for CPI2 and REER at 36 currency index have been taken from the RBI Bulletin.3 Overall FDI outflow data are taken from UNCTAD Stat, whereas value added of the manufacturing sector, that is, GVA at current prices has been retrieved from World Bank. The relevant data is collated in Appendix.

Key Analysis and Results

Performing Some Diagnostic Tests

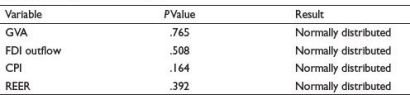

Normality Test

Prior, the efficiency of the model is checked through the normality of the variables, stationarity test or unit root test, autocorrelation and multicollinearity of the time series data. Jarque–Bera test is used to see the normality of the variables. The summary statistic of the same is mentioned in Table 1.

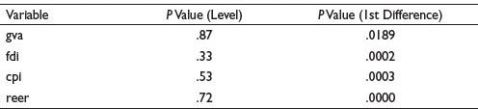

Stationarity Test

Since it is time series data, there is a need to check stationarity of the series using the unit root test. The augmented Dickey–Fuller test is used to see the stationarity of the variables in the model knowing the usage of non-stationary variables can lead to spurious and non-reliable results. Using Stata, Mackinnon approximate p value for level and first difference equation is presented in Table 2.

Table 1. Jarque–Bera Test Results.

Table 2. P Value Estimates for Level and First Difference.

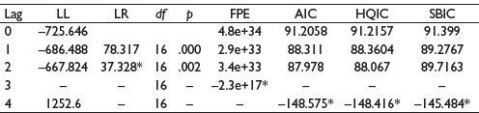

Table 3. Selection Order Criterion.

Since all the variables or the entire series are non-stationary at level and as the trend of the series is stochastic, therefore differencing helps remove the problem of non-stationarity. So, I adopt the same process to run the augmented Dickey-Fuller (ADF) test at first difference with trend. As seen through the table, the p value of GVA, FDI, REER and CPI are stationary at first difference form by rejecting the null hypothesis at 5% significant level. Based on ADF test results, it can be concluded that all variables in the model have reached stationarity in first difference instead of level form. It also implies that the whole series have integrated of order one [I (1)]. Therefore, cointegration test analysis is applicable for further approach. Before checking for cointegration, it is necessary to find the optimal lag for our model and also perform the causality test.

Optimal Lag Selection

Table 3 provides the summary statistics of the lag selection order criterion using ‘Varsoc’ command in Stata.

The optimal lag is determined by the Akaike Information Criteria since the sample size of the data is small, that is, just 20 observations. From Table 3, the least value obtained is –148.57. Thus, the optimal lag that can be used for our model is 4.

Granger Causality Test

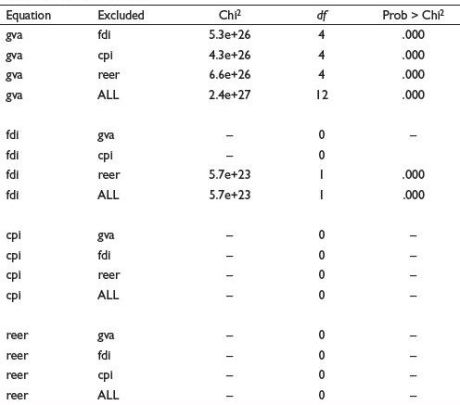

Granger causality test is used to test for short-run relationship and for that matter, the series have been converted to make it trend stationary. The results of the Wald test are presented in Table 4.

It is evident that fdi, cpi and reer Granger cause gva and also reer granger causes fdi. There is unidirectional causality from the independent variables to the dependent variables chosen in the model. In other words, the Wald test supports the model chosen in this article. Hence, FDI outflow, CPI and REER are all imperative for manufacturing sector growth in our country.

Table 4. Granger Wald Test.

Cointegration Test

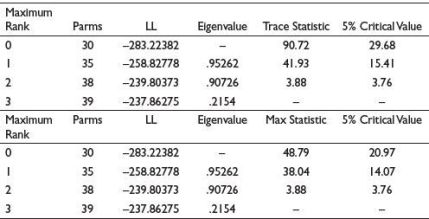

At max rank 0:

The trace statistic is 90.72 and 5% critical value is 29.68 (as indicated in Table 5). Now, since the trace statistic is more than 5% critical value, we reject the null hypothesis meaning the time series variables are gva, fdi, cpi and reer are cointegrated. The maximum statistic is 48.79 and 5% critical value is 20.97. Again, as the maximum statistic is more than 5% critical value, we reject the null, and hence, there is cointegration in the model.

At max rank 1:

The trace statistic is 41.93 and 5% critical value is 15.41. Now since the trace statistic is more than 5% critical value, we reject the null hypothesis meaning the time series variables are gva, fdi, cpi and reer are cointegrated. The maximum statistic is 38.04 and 5% critical value is 14.07. Again, as the maximum statistic is more than 5% critical value, we reject the null, and hence, there is a cointegration of Equation 1 in the model.

Table 5. Results of Johansen’s Test for Cointegration.

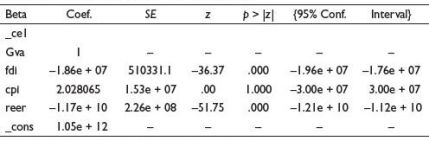

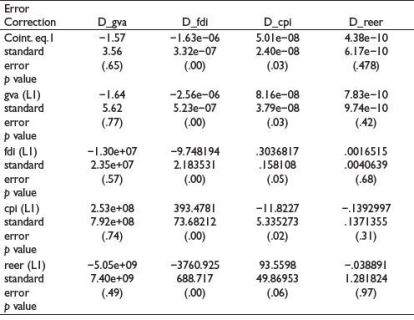

Table 6. Results of Vector Error Correction Model.

Note: Johansen’s normalization restriction imposed.

At max rank 2:

The trace statistic is 3.88 and 5% critical value is 3.76. Now since the trace statistic is more than 5% critical value, we reject the null hypothesis meaning the time series variables are gva, fdi, cpi and reer are cointegrated. The maximum statistic is 3.88 and 5% critical value is 3.76. Again, as the maximum statistic is more than 5% critical value, we reject the null, and hence, there is cointegration of Equation 2 in the model.

Now, since there is cointegration in the model, we will now proceed estimating the long-run behaviour of the model using VECM.

Vector Error Correction Model

The long-run behaviour between the dependent variable and independent variables:

Putting together, fdi and reer has a positive impact on gva, whereas cpi has a negative effect on gva. The coefficients, that is, fdi and reer are statistically significant at 1% level referring the p value, whereas cpi is not. Concluding, it can be said that all the independent variables have an asymmetric effect on the gva, that is, the dependent variable in the long run, on average, ceterus peribus.

Note: The values here are represented only till lag 1 since the values at further lags were found insignificant.

The negative error correction term in gva and fdi equations is good since it shows convergence to the long-run equilibrium. Hence, there is long-run causality in gva and fdi equations, among which fdi is statistically significant at 1% level.

The short-run behaviour between the dependent variable and independent variables:

In the short run, gva, cpi and reer are seen to have a significant effect on fdi at 1% level. Fdi and gva also have a significant effect on cpi at 5% level whereas reer have a significant impact on cpi at 10% level. However, there is no causality from fdi, reer and cpi to gva in short run. Concluding, we cannot infer strong causality from independent to dependent variables in the short run.

Conclusion

The study has explored the inter linkage between FDI outflow and manufacturing sector growth in India and measured the role of selected economic factors such as CPI and REER. The empirical analysis is based on the long-term cointegration model using the last two decades data (2000–2019). The study finds out that FDI outflow has direct significant effect on manufacturing sector growth in India. Moreover, the analysis also revealed that the price level and foreign exchange influence the relationship between FDI outflow and growth of the manufacturing sector. While CPI has an adverse impact on manufacturing sector growth, REER has a positive influence on the relation.

Despite theoretical evidence of bidirectional relationship between the factors, this study only confirms (through Granger causality) uni-directional relationship for the period 2000–2019. However, the results are largely in line with the literature. The positive impact of outward FDI on domestic growth of the manufacturing sector in India can be explained through the supply of important raw materials at affordable costs. This also ensures reliable supply of those raw materials for indigenous production. This allows the domestic manufacturing sector to produce goods at affordable cost in India. Owing to the affordability, the demand of goods increases leading to an increase in output and hence overall growth of the investing country. However, FDI outflows also instigate economic growth of investing/source country because investing in other countries allows the domestic firms to expand its operations in the foreign market in turn contributing to domestic growth. The returns on investment in terms of high foreign exchange inflow are also very crucial for the economic growth of a country.

The findings of this article have significant policy implications. To promote economic growth especially growth of the manufacturing sector, FDI outflow may be the alternative tool as the country can decide on it unlike FDI inflow on which there is relatively less control. Investment on FDI outflow can stimulate the growth of the manufacturing sector in the host country through the channels described in the previous paragraph. Moreover, through proper management of REER and control of CPI, the impact of FDI outflow on the manufacturing sector growth can be augmented. As CPI has an inverse relationship, policymakers can choose to reduce it through various policy measures to stimulate manufacturing sector growth. Similarly, REER can be modified through trade policies to influence manufacturing sector growth and, in turn, promote economic growth in the host country.

However, the destination of FDI outflow may have a significant effect but that needs to be confirmed with further analysis. Moreover, the result is not significant for the relation between CPI and manufacturing sector growth, probably due to the change in the methodology of the data collection pre- and post-2012 as referred by the RBI Bulletin.

Appendix

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Notes

Aboobucker, H., & Jahufer, A. (2018). Impact of consumer price index and gross domestic saving on economic growth in Sri Lanka: An econometric analysis using Johansen co-integration approach. International Journal of Science and Research, 7(9), 415–419. https://doi.org/10.24940/ijird/2018/v7/i8/AUG18054

Banga, R. (2004). Impact of government policies and investment agreements on FDI inflows [Working Paper No. 116]. Indian Council for Research in International Economic Relations. https://www.icrier.org/pdf/WP116.pdf

Banga, R. (2008). Drivers of outward foreign direct investment from Asian developing economies. Asia-Pacific Trade and Investment Review, 4, 195–215. https://www.academia.edu/57592447/VII_Drivers_of_Outward_Foreign_Direct_Investment_from_Asian_Developing_Economies

Bano, S., & Tabbada, J. (2015). Foreign direct investment outflows: Asian developing countries. Journal of Economic Integration, 30(2), 359–398. https://doi.org/10.11130/jei.2015.30.2.359

Bhasin, N., & Kapoor, K. (2019). Impact of outward FDI on home country exports. International Journal of Emerging Markets, 16(6), 1150–1175. https://doi.org/10.1108/IJOEM-05-2017-0160

Devajit, M. (2012). Impact of foreign direct investment on Indian economy. Research Journal of Management Sciences, 1(2), 29–31. http://www.isca.me/IJMS/Archive/v1/i2/5.ISCA-RJMgtS-2012-020.pdf

Eaton, J., & Tamura, A. (1994). Bilateralism and regionalism in Japanese and US trade and foreign direct investment relationships. Journal of Japanese and International Economics, 8(4), 478–510. https://doi.org/10.1006/jjie.1994.1025

Grosse, R., & Trevino, L. J. (1996). Foreign direct investment in the United States: An analysis by country of origin. Journal of International Business Studies, 27(1), 139–155. https://www.jstor.org/stable/155375

Gumbe, S. M., & Kaseke, N. (2009). Manufacturing firms and hyperinflation-survival options: The case of Zimbabwe manufacturers. Journal of Management and Marketing Research, 1–22. https://www.aabri.com/manuscripts/10667.pdf

Imbriani, C., Pittiglio, R., & Reganati, F. (2011). Outward foreign direct investment and domestic performance: The Italian manufacturing and services sectors. Atlantic Economic Journal, 39(4), 369–381. http://doi.org/10.1007/s11293-011-9285-z

Joseph, R. K. (2019). Outward FDI from India: Review of policy and emerging trends [Working Paper 214]. Institute for Studies in Industrial Development. https://isid.org.in/wp-content/uploads/2022/07/WP214.pdf

Kogid, M., Asid, R., Lily, J., Mulok, M., & Loganathan, N. (2012). The effect of exchange rates on economic growth: Empirical testing on nominal versus real. The IUP Journal of Financial Economics, 10(1), 1–17. https://ssrn.com/abstract=2156115

Koirala, S. (2018). An analysis of the impact of real effective exchange rate on economic growth of Nepal. Pravaha Journal, 24(1), 206–216. https://doi.org/10.3126/pravaha.v24i1.20239

Korkmaz, S. (2013). The effect of exchange rate on economic growth [Working Paper]. https://www.researchgate.net/profile/Suna-Korkmaz/publication/311588566_The_Effect_of_Exchange_Rate_on_Economic_Growth/links/584fc44c08ae4bc8993b33f2/The-Effect-of-Exchange-Rate-on-Economic-Growth.pdf

Liu, W. H., Tsai, P. L., & Tsay, C. L. (2015). Domestic impacts of outward FDI in Taiwan: Evidence from panel data of manufacturing firms. International Review of Economics & Finance, 39, 469–484. https://doi.org/10.1016/j.iref.2015.07.011

Nanda, N., Choudhary, S., & Tyagi, B. (2020). Impact of FDI on economic growth in South Asia: Does nature of FDI matters. Review of Market Integration, 12(1–2), 51–69. https://doi.org/10.1177/0974929220969679

Nayyar, R., & Mukherjee, J. (2020). Home country impact on outward FDI from India. Journal of Policy Modelling, 42(2), 385–400. https://doi.org/10.1016/j.jpolmod.2019.06.006

Pradhan, J. P. (2017). Indian outward FDI: A review of recent developments. Transnational Corporations, 24(2), 43–70. https://doi.org/10.18356/32864c71-en

Sahoo, P., & Bishnoi, A. (2021). Impact of outward FDI: Evidence from emerging economies in Asia [IEG Working Paper 433]. Institute of Economic Growth. https://ideas.repec.org/p/awe/wpaper/433.html

Srikanth, M., & Kishore, B. (2012). FDI and its impact on Indian economy: An empirical investigation. Foreign Trade Review, 46(4), 3–17. https://doi.org/10.1177/0015732515120401

Surugiu, M. R., & Surugiu, C. (2015). International trade, globalization and economic interdependence between European countries: Implications for businesses and marketing framework. Procedia Economics and Finance, 32, 131–138. https://doi.org/10.1016/S2212-5671(15)01374-X

Thomas, R., & Narayanan, K. (2017). Determinants of outward foreign direct investment: A study of Indian manufacturing firms. Transnational Corporations, 24(1), 9–26. https://unctad.org/system/files/official-document/diaeia2017d2a2_en.pdf

Tolentino, P. E. (2010). Home country macroeconomic factors and outward FDI of China and India. Journal of International Management, 16(2), 102–120. https://doi.org/10.1016/j.intman.2010.03.002

Vorlak, L., Abasimi, I., & Fan, Y. (2019). The impacts of exchange rate on economic growth in Cambodia. International Journal of Applied Economics, Finance and Accounting, 5(2), 78–83. http://doi.org/10.33094/8.2017.2019.52.78.8

Yang, S. F., Chen, K. M., & Huang, T. H. (2013). Outward foreign direct investment and technical efficiency: Evidence from Taiwan's manufacturing firms. Journal of Asian Economics, 27, 7–17. https://doi.org/10.1016/j.asieco.2013.04.007