1Institute of Public Enterprise, Shamirpet, Hyderabad, Telangana, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Retailer is the last channel partner of any distribution chain. Retailer plays a very important role in the sale of manufactured goods or service. The customer provides a lot of insights at the retail point on the products and services sold by different manufacturers. These insights are very essential in the development of new products. In the case of large manufacturers, they have different sources of customer insights and product strategies to come out with new innovative products and move up in the market. But for small and medium suppliers/manufacturers, with limited resources and information, it is not easy. In such situations, retailers play a very important role in providing insights to these small and medium suppliers/manufacturers and help them in making alterations to the existing products, developing new products or introducing their existing products in new markets. This brings in the need for exploration and validation of various parameters that define efficiency in modern retail. The modern retailer can always pose challenges to small and medium industries/suppliers in making onerous trade agreements, including credit limit, credit period and sale-or-return, which squarely place the burden of funding the retailer’s business on the small and medium enterprises (SME)/supplier, and so on. Unless there is a mandate of better payment terms, the evolution of modern retail can spell an end to barely alive Indian SMEs. As part of this study, small and medium suppliers/manufacturers were interviewed for various parameters that would have an impact on their innovation capabilities. With the help of analysis, it is proved that there is a significant impact created by these large companies on their innovation capacities. Unless there is a mandate of better payment terms and knowledge sharing system, the evolution of modern retail can spell an end to barely alive Indian SMEs.

Modern retail, suppliers, innovation, channel partners, manufacturers, enterprises

Introduction

Over the last 20 years there is a rapid transformation in the ecosystem of Indian retailing. Retail business is passing through a transitional phase, and emerging markets like India are witnessing a major change and consequentially there is a growth in organised retail. The Indian retail segment is predominantly unorganised with a minor component of organised retiling, which also constitutes online retail. Growth of online retail has contributed a lot to the overall growth of organised retailing in India. Till mid-90s, the retail sector in our country was typically unorganised, evolved consumerism and with the evolution of preferences and tastes, resulted in the modernisation of retail business and which resulted in the industry getting more prevalent and organised.

Logistics, storage infrastructure and sophisticated distribution process are very critical for the success of the retail business. These key elements help retailers to gain a competitive advantage over the other retailers. The Indian food retailing, which contributes to around 90% of the trade, is been driven by small and independent sellers. It is very important to note that these traders are highly heterogeneous, fragmented and run their businesses with moderate or little technology. The growth of modern/organised retailing had brought with it some of the innovative procurement systems, stock/inventory management tools and right delivery of efficient client response system and other innovations in the field of product development as well. In the last two decades, the evolution of modern retailing in India has brought a considerable surge in the level of investment in the supply chain and logistics dynamics and that cascaded effort could have a significant influence on the total transportation cost suffered in the economy. In the existing literature, here are research studies which have revealed that an efficient supply chain helps in adding 20%–25% additional advantage to buyers and 24%–48% additional savings to producers. As per the previous studies, it is also proved that the collaboration between native producers/manufacturers and modern retailer’s buying strategies is expected to help the country’s economy and also benefit them to the advantage of the association with local suppliers. However, some of the studies that were conducted in 10 nations categorically defined as developing nations show that the advantage of decreased cost will occurs over a long period of time when the modern/organised retailer ultimately hit the efficacy with central controlling system, new and innovative techniques and modern technology implementation (Minot & Roy, 2007; Reardon & Timmer, 2007).

Organised retailers pursue to the extent possible to positively impact the consumer buying decision-making process by giving the consumers competing good quality goods at reasonable prices. Private brands or store labels are becoming strategically important parts of big modern retailers’ product assortment to increase the walk inns. Even though the store brand concept is not very prominent in the Indian markets, it is growing at a rapid pace. Non-food retailers, mainly electronics and electrical appliances and clothing tend to manage a good number of private-label product categories to offer a wide variety. Private labels are one area where modern retailers depend on micro small and medium enterprises (MSMEs) for their production. In order to have successful private labels, retail brands are required to put a lot of effort in establishing product specifications, quality parameters, branding, and so on. In some of the cases, private labels would be having head-on completion from the established brands. Innovation is very important to have successful private labels.

Modern retailing is considerably a large sector with multiple business prospects to budding entrepreneurs and investors. Apart from that, in developing countries like India, modern retailing is highly relevant in offering an all-round experience to the consumers keeping in view their ever-changing needs and demands. The broader benefits of modern retail can be seen in terms of improved supply chain efficiency, enhanced output of agriculture producers and it is also clear that it will assist in uplifting economic activity.

In the literature available, it can be inferred that there is a considerable impact of power of one of the associates on the buyer–supplier relationship. It is evident from the previous studies that the power is not balanced and it is mostly asymmetric (Hingley, 2005), anyway, Hingley’s observation about imbalance of power is not always undesirable in the context of having long-term association. As argued by Blois (1999), it is legitimacy and prestige that play a very important role in balancing the shift of power in the association. It is also very important to understand whether the part will really use the power and if so for what purpose the company will use it.

Buyer–supplier association exists in many ways, with different levels of commitment and collaboration. In the case of organised food retailers, supplier associations are highly inclined by the fact that they are inclined to be a few leading food retailers, holding as the ‘gate-keeper’ between consumer and producer (Robson & Rawnsley, 2001). When it comes to food retailing, food retailers depend on a large number of suppliers and most of these suppliers depend on these retailers for their existence. Organised food retailers have been pushing huge investments into supporting and sustaining enduring supplier relations with the fundamental goal of accomplishing optimum efficiency.

Krishnan et al. (2006) have argued that the imbalance of power and dependency of one player on another may not result in the dominancy of more power players on the other. One of the challenges with the understanding of the kind of trust that goes in seller–buyer association is the amount of trust. This trust is mostly dependent on the viewpoint (Nielson, 1998). Sutton-Brady (2008) and Reitz et al. (1979) have argued that the dependence when viewed in the backdrop of essential resources is very simple to understand that the organisation that has essential and important resources will have the power over the other party which is lacking the resources. Emerson (1962) believes that the power and dependence are intrinsically interwoven; ‘power resides implicitly in the other’s dependency’. Dependency is influenced by two variables—the motivational investment of one party’s goals influenced by the other party, and the availability of those goals outside this relationship.

Duffy and Fearne (2004) are of the opinion that both supplier organisation and customers try to have association that is of collaborative nature with the partnering organisations to improve efficiency. Kalwani and Narayandas (1995) state that the supplier organisations can attain good sales volumes and make higher earnings from investments invested in partnering long-term associations with their clients. Lee and Whang (2001) study conducted in collaboration with Stanford University and Accenture on hundred manufacturing organisations along with hundred modern retailers in the consumer and food sector disclosed the facts that establishments which have reported returns that are greater than average returns are the entities that were having higher collaboration with reference to information sharing with the one another. Duffy and Fearne (2004) and Mohr and Spekman (1994) are of the opinion that the higher the level of interdependence (i.e., higher level of collaboration) in a relationship the better the firm performance.

In terms of foreign direct investment (FDI), India is one among the top destinations in the world, garnering inflows of $49 billion in calendar 2019, according to United Nations Conference on Trade and Development (UNCTAD). In total, 85% of all the FDI that comes into South Asia flows into Indian business. One of the important identified results was to rise the proportion of the core manufacturing segment to 25% of GDP.

According to the study that was conducted by Chawla et al. (2018) with the title ‘A Critical study of FDI in Indian Retail Sector: An Analysis of Impact on Stakeholders’, it was found that the retailing is playing a pivotal role in the supply chain management of the country. Retailers are the people who are having connections with consumers as a result of which it is playing a key role in the manufacturer’s end too.

Methodology

The present research study has primarily used primary data and the data is collected from small and medium suppliers supplying various products to organised retailers in Hyderabad. As per the interactions with the modern retail managers, any supplier supplying less than 10 lakhs worth of goods to the retailer they are termed as small supplier and if the value ranges from 10 lakhs to 20 lakhs, they are termed as medium suppliers. These small-scale vendors are either manufacturers or traders of the products that they supply. The sample considered for the research include suppliers of different types of products like disposables, plastic, foods, foot ware, garments, home decors, and so on.

As part of primary data collection from small and medium suppliers to large modern retailers, big brands in the retail business are identified (list as shown in Table 1). Upon interaction with the brands, suppliers to these brands are listed. As per the understanding, a supplier with annual turnover of less than 5 lakhs in a financial year is considered as small-scale supplier. Suppliers with annual turnover of less than 20 lakhs are termed as medium supplier. By applying appropriate filters, for each brand list of small and medium suppliers are identified (as shown in Table 1).

As shown in Table 1, a total of 30% of the population from the entire population with representation of 30% from each retailer is taken for the study. Apart from primary data, secondary data is also collected from numerous sources is been used. Important retrieved sources for this study contain business reports and articles from renowned academic journals and renowned studies on the topic. EBSCO host’s Business Source Premier, Emerald Insight and EconLit, JSTOR (online periodical databases) were also used as the primary information sources in obtaining peer-reviewed academic and practitioners’ journals. The popular studies on the topic have been obtained from the websites of Asian Development Bank (ADB), A. T. Kearney, The World Bank, National Bank for Agriculture and Rural Development (NABARD), Central Statistical Organisation, and so on, in each company is considered as sample size and same has been contacted by using Stratified random sampling technique. Data are collected through the well-framed questionnaire, which covers all the objectives of the present research.

Table 1. Sampling.

As per the available literature review in the first part of the article, the following parameters are tested in order to understand the influence and support system created by modern retailers in building the innovation capabilities of small and medium scale suppliers supplying products to retailers.

Hypothesis

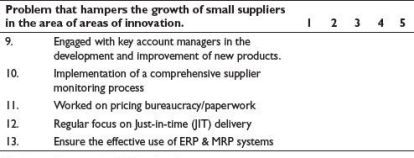

A hypothesis is designed to examine if there are significant problems that are hampering the innovation abilities of small suppliers by the modern retailers. Independence t-test has to be done and descriptive statistics has also to be done to assess the sanity of the data. Some of the identified variables in the area of innovation are identified as follows: engaged with the key account managers in the development and improvement of new products; implementation of a comprehensive supplier monitoring process; worked on pricing bureaucracy/paperwork; regular focus on JIT delivery; and ensure the effective use of ERP & MRP systems.

H0: It is proposed that there is no significant problem that hampers the growth of small suppliers in the areas of innovation.

vs.

Ha: It is proposed that there is a significant problem that hampers the growth of small suppliers in the areas of innovation.

Analysis

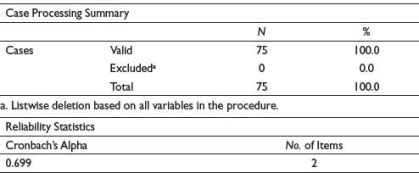

Reliability Test

Further to the calculation of Cronbach’s alpha in line with all the calculated factors will result in average scale or results. For the present data Cronbach’s alpha value is 0.699, which is below accepted level of 0.70. It can now be concluded that the data is fit and the same can be used for further analysis.

It is also important to note that the mean score of each of the parameter is close to 2.66 and for the 75 respondents the calculated standard deviation is 0.687.

The calculated Cronbach alpha value for all the attributes used in the study is greater than .70, with these results, it can be concluded that apart from overall alpha value being in the acceptable level, the individual alpha value is also reliable to carry out the further analysis.

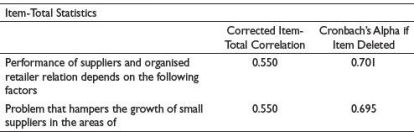

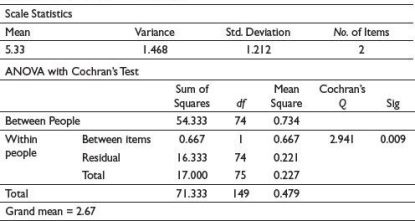

Analysis of variance (ANOVA) with Cochran’s test has resulted in p value

< .05, as the p value is less than .05, which means it is significant, at 95% confidence level it can be assumed that the data used in the research is consistent and it can be used for further analysis. Analysis has resulted in the mean of 5.33 and a standard deviation of 1.212.

Table 2. Reliability Test.

Table 3. Item Statistics.

Table 4. Item-Total Statistics.

Table 5. ANOVA with Cochran’s Test.

|

Scale Statistics |

|||

|

Mean |

Variance |

Std. Deviation |

No. of Items |

|

5.33 |

1.468 |

1.212 |

2 |

In continuation with the data reliability tests indicated in Table 1–4 and Analysis of variance (ANOVA) with Cochran’s test (shown in Table 5) indicate p value < .05, as the p value is less than .05, which means it is significant, at 95% confidence level it can be assumed that the data used in the research is consistent and it can be used for further analysis. Analysis has resulted in the mean of 5.33 and a standard deviation of 1.212.

Hypothesis

Null Hypothesis (Ho): There is no significant problem that hampers the growth of small suppliers in the areas of innovation (Table 3 and Table 4).

vs.

Alternate Hypothesis (Ha): There is a significant problem that hampers the growth of small suppliers in the areas of innovation.

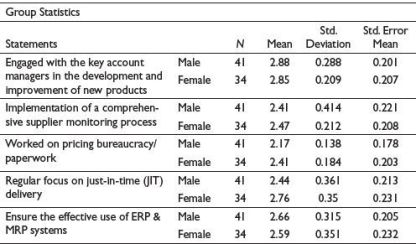

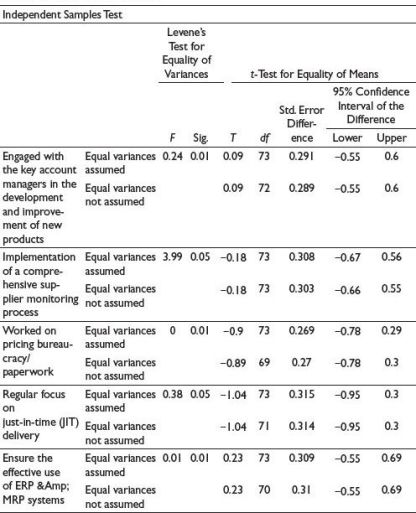

To examine the significant problems that hamper the growth of small suppliers in the areas of innovation independence t-test has been done at the gender level as shown in Table 6. Descriptive statistics have also been done to assess the sanity of the data. As per the results at a 95% confidence level, in regards with problems that hamper the growth of small suppliers in the areas of innovation, the mean value of the data is 2.56 and the standard deviation is 0.282. In the data, not much deviation has been seen in the variables as compared with mean.

Concluding Remarks: The independence t-test table contains inferential t-test statistics. Table 7 significantly tells whether there is any statistical difference between equal variances assumed and equal variances not assumed. This table also helps in understanding whether the null hypothesis is in favour or not in favour of the research hypothesis. The most important columns in the above table are as follows:

Levine’s test for equal variance, this is the first section of the Independent Samples Test. If the probability level or significance level is higher than .05 then that means there is equal variance between the variables. Here, in the study on problems that hamper the growth of small suppliers in the areas of revenue generation probability value is less than .05 for all the variables or factors; hence, the second row has been used for the results.

Therefore, at a 95% confidence level, it can be concluded that there are problems hampering the growth of small suppliers in the areas of innovation. Ha is accepted.

Table 6. Independence t-Test at Gender Level.

Table 7. Independent Sample Test.

Conclusion

Some of the major long-term hurdles that Indian small-scale industries are facing include adequate infrastructure, compliances that can hold SME operations hostage under outdated laws, inadequate funding, innovations, patents, and so on. Growth of modern retail is built on the pillars of efficient small industries. This brings in the need for exploration and validation of various parameters that define the efficiency in modern retail. A modern retailer can always pose challenges to small industries/suppliers in making onerous trade agreements, including credit limit, credit period and sale-or-return, which squarely place the burden of funding the retailer’s business on the SME/supplier, and so on. Unless if there is a mandate of better payment terms, the evolution of modern retail can spell an end to barely alive Indian SMEs.

Annexure

Questionnaire

Growth of Modern Retail and Its Impact on Innovation of Small and Medium Enterprises/Suppliers: A Study with Special Reference to India

Dear Respondents,

My research topic falls within the organised retailers. In this regard, I am approaching you with a request to fill in the questionnaire, which will take about 15 minutes. Data collected through this questionnaire will be used strictly for academic purposes only. This questionnaire aims to understand the performance of organised retailers and sustainability of small and medium suppliers. This survey is purely conducted for academic purpose only. Responses to this questionnaire will be kept strictly confidential.

A. Please answer a few questions based on students profiling

1. Please specify your age (Years):

2. Please specify your gender:

3. Please specify your qualification:

4. Which categories of the product do you sell to the organised retailers?

5. How long are you associated with organised retail?

6. How many organised retail you are associated with?

7. Are you satisfied with your association with organised retail?

8. How you faced any problem with your relationship with any of the organised retail?

B. Please specify the extent of supply chain integration between organised retailer and supplier. Please indicate the extent you agree or disagree with each statement as it pertains to the terms and conditions of the organised retailer.

(Strongly agree = 1, agree = 2, neither agree nor disagree = 3, disagree = 4, strongly disagree = 5)

Thank you for your valuable feedback

Declaration of Conflicting Interests

The author declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

Blois, K. J. (1999). Trust in business to business relationships: An evaluation of its status. Journal of Management Studies, 36(2), 197–215. https://doi.org/10.1111/1467-6486.00133

Chawla, J., Agrawal, R., & Sharma, B. (2018). A critical study of FDI in Indian retail sector: An analysis of impact on stakeholders. Asian Journal of Management, 9(1), 531. https://doi.org/10.5958/2321-5763.2018.00083.5

Duffy, R., & Fearne, A. (2004). The impact of supply chain partnerships on supplier performance. The International Journal of Logistics Management, 15(1), 57–72. https://doi.org/10.1108/09574090410700239

Emerson, R. M. (1962). Power-dependence relations. American Sociological Review, 27(1), 31–41. https://doi.org/10.2307/2089716

Hingley, M. K. (2005). Power imbalanced relationships: Cases from UK fresh food supply. International Journal of Retail & Distribution Management, 33(8), 551–569. https://doi.org/10.1108/09590550510608368

Kalwani, M. U., & Narayandas, N. (1995). Long-term manufacturer-supplier relationships: Do they pay off for supplier firms? Journal of Marketing, 59(1), 1–16. https://doi.org/10.1177/002224299505900101

Krishnan, R., Martin, X., & Noorderhaven, N. G. (2006). When does trust matter to alliance performance? Academy of Management Journal, 49(5), 894–917. https://doi.org/10.5465/amj.2006.22798171

Lee, H. L., & Whang, S. (2001). Winning the last mile of e-commerce. MIT Sloan Management Review, 42(4), 54–62.

Minot, N., & Roy, D. (2007). Impact of high-value agriculture and modern marketing channels on poverty: An analytical framework. IFPRI Food Policy Review. https://docplayer.net/19180226-Impact-of-high-value-agriculture-and-modern-marketing-channels-on-poverty-an-analytical-framework.html

Mohr, J., & Spekman, R. (1994). Characteristics of partnership success: Partnership attributes, communication behavior, and conflict resolution techniques. Strategic Management Journal, 15(2), 135–152. https://doi.org/10.1002/smj.4250150205

Nielson, C. C. (1998). An empirical examination of the role of ‘closeness’ in industrial buyer-seller relationships. European Journal of Marketing, 32(5/6), 441–463. https://doi.org/10.1108/03090569810215812

Reardon, T., & Timmer, C. (2007). Transformation of markets for agricultural output in developing countries since 1950: How has thinking changed? In Handbook of Agricultural Economics (pp. 2807–2855). Elsevier. https://doi.org/10.1016/S1574-0072(06)03055-6

Reitz, H. J., Pfeffer, J., & Salancik, G. R. (1979). The external control of organizations: A resource dependence perspective. The Academy of Management Review, 4(2), 309–310. https://doi.org/10.2307/257794

Robson, I., & Rawnsley, V. (2001). Co-operation or coercion? Supplier networks and relationships in the UK food industry. Supply Chain Management: An International Journal, 6(1), 39–48. https://doi.org/10.1108/13598540110384279

Sutton-Brady, C. (2008). As time goes by: Examining the paradox of stability and change in business networks. Journal of Business Research, 61(9), 968–973. https://doi.org/10.1016/j.jbusres.2007.11.001