1 Birla Institute of Technology & Science (BITS), Pilani, Rajasthan, India

2 Lingayas Lalita Devi Institute of Management and Sciences, New Delhi, India

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

This research study aims to explore whether the impact of the pandemic on different sectors was reflected in the stock market returns or not. The study has taken eight sectors of the Indian economy and started with the assumed impact of the pandemic on those industries based on popular perceptions. Then, it validated the assumed impact with the help of the analysis of the financial statements. Once the impact has been validated with the help of the financial statements, the effect on the stock market returns has been computed by comparing the changes in the stock returns for each industry with those in the index returns from the pre-pandemic times to post-pandemic times. The study reveals that the stock returns in most of the sectors reflected the influence of the pandemic on the businesses with a few exceptions. The exceptions where the stock market returns did not reflect the influence of the pandemic have been explained with the help of the measures taken by the businesses to mitigate the effect of the pandemic or with the help of other intervening factors.

Coronavirus pandemic, business cyclicity, equity returns, economic development, business performance

Introduction

The Covid-19 pandemic has impacted economies across the globe (Dinh & Narayan, 2020; Salisu et al., 2022). Since the advent of the pandemic was followed by lockdowns, it led to the recessionary phase in the business cycle of most of the nations. The recessionary phase is bound to occur as a natural phenomenon in the business cycles. However, recessions differ from each other in terms of nature, policy response and structural disruption caused. For example, COVID-19 was a biological disaster that gradually evolved into an economic crisis (Ozili, 2020) as against the subprime crisis of 2008 and the dotcom crash of 2000 which were driven by financial indiscipline (Jermann & Quadrini, 2012). In addition, COVID-19 has been claimed to be one of the most severe and dangerous crises in the history of mankind (Sukharev, 2020).

The pandemic brought a mixed bag of outcomes for the different sectors. While certain sectors have been positively impacted by the pandemic, many of the sectors have been negatively impacted. There also exist a few industries such as the fast moving consumer goods (FMCG) industry that have not witnessed any significant growth or decline with the pandemic.

It has been said that the market returns on an equity stock are a reflection of

the performance of the underlying firms (Mohanram, 2005). It is expected that the firms should witness higher-than-average returns on their stocks during the positive business cycles and lower-than-average returns on their stocks during

the negative business cycles. The relevance of financial reporting to the stock markets can be even more for the emerging markets than the developed economies (Mirza et al., 2019). In addition, stock markets have been proven to be a reflection of economic growth also (Hoque & Yakob, 2017).

The initial response of the overall stock markets to the pandemic was negative but short-lived (He et al., 2020). There was increased volatility in the markets globally during the initial stage of the pandemic (Mobin et al., 2022; Rakshit & Neog, 2021). Post that, the equity markets World over have witnessed a substantial rise in the overall index value, implying that there has been a positive impact of the macroeconomic factors such as easing of liquidity measures and pumping of money by the government into the economy. In such a case, it can be expected that the sectors that are positively impacted by the pandemic must witness a higher rise in their returns as compared to the rise in the returns on the market index. At the same time, the sectors that are negatively impacted by the pandemic must witness a lower rise or a fall in their returns as compared to the rise in the returns on the market index.

In addition, it has been observed that the firms that have been able to digitalise their business processes were better prepared to face the challenges posed by the pandemic (Matalamaki & Joensuu-Salo, 2021; Xu et al., 2021). So, within any sector, different firms can have been impacted in different ways by the pandemic depending on their level of agility, contingency plans, and so on. In addition, the degree of agility exhibited by a firm is dependent on the organisational systems (Mandal & Dubey, 2021), supply chain resilience (Nikookar & Yanadori, 2022; Panigrahi et al., 2022), human capital management strategy (Alipour, 2012; Douglas, 2021; Moustaghfir, 2008; Nadeem et al., 2017), creative climate (Farooq et al., 2021; Ibarra-Cisneros & Hernandez-Perlines, 2020; Mafabi et al., 2015), innovation (Ammirato et al., 2021; Pratono, 2021), ability to cope up with threats and take advantage of the opportunities (Waal, 2021), risk management solutions (Calandro & Lane, 2006), and so on.

There has not been any research study to validate the effect of pandemic-induced performance changes on the stock market returns. Therefore, this study intends to confirm whether the effect of the pandemic on the sector’s performance in India is reflected in its equity returns or not. This is particularly important to check since the investors are subject to bounded rationality, and there is some herding behaviour that the markets got subjected to during the crisis period (Wu et al., 2020), along with the information asymmetry (Park et al., 2021).

This research study has been structured as follows. The first section discusses the motivation behind the study while the second section performs the review of the existing literature on the topic, and identifies the gap in the existing literature that this study addresses. The second section also results in deriving the research hypothesis that this study attempts to test. The third section discusses the research methodology in detail and explains the three broad steps followed in this study. The fourth section elaborates the findings of the study, while the fifth section sheds light on the implications of this research study for the investors. The fifth section concludes the article while mentioning the limitations of the research and the possible research extensions of this study that can be explored in the future.

Literature Review and Research Hypothesis Formation

COVID-19 has been a very severe pandemic and has brought about the worst economic recession in the past (Borio, 2020; Chaudhary et al., 2020; Verma et al., 2021). Many of the industries bore the brunt of the pandemic. Some of such examples are aviation (Abu-Rayash & Dincer, 2020; Agrawal, 2020; Sun et al., 2021), travel and tourism (Mroz, 2021; Skare et al., 2021; Toubes et al., 2021), and hospitality (Crespí-Cladera et al., 2021; Pillai et al., 2021; Sharma et al., 2021).

There also exist cases of a few industries that have benefited immensely from the pandemic. A few such examples are Edu-tech (Dam?a et al., 2021; Maity et al., 2021; Milenkova & Lendzhova, 2021), healthcare (Nguyen et al., 2021), insurance (Harris et al., 2021; Riyazahmed, 2021), IT-enabled services (Bai et al., 2021; Casale et al., 2021; Dash & Chakraborty, 2021; Feroz et al., 2021) and e-commerce (Silva & Bonetti, 2021; Singh et al., 2021). While a few sectors such as the FMCG sector have been quite neutral to the influence of the pandemic (Shetty et al., 2020).

The cash flows from all three types of activities, whether operating, investing, or financing influence the stock returns (Chu, 1997). Therefore, returns on any equity stock are dependent on the fundamental performance of a firm (Navas et al., 2016). In addition, analysing the financial performance of the stocks before investing leads to significantly better returns on the investing decisions (Piotroski, 2000).

Post the pandemic, almost all the capital markets the world over have seen a bull run with the market capitalisation having substantially increased as a percentage of economic output or GDP. In the Indian equity market, the market cap to the GDP ratio got close to 1 for the first time in the history of the Indian equity market. The overall market index has almost doubled in the period from April 2020 till December 2021.

As the returns in the equity markets are dependent on the underlying performance of any sector, it can be expected that the increase in returns for the pandemic-positive sectors should significantly exceed the increase in market returns. Similarly, the increase in returns in the pandemic-negative sectors should be lower than those in the market returns. Since no research work has been done to validate this hypothesis, this research study has been taken to check whether the stock market returns reflect the pandemic’s influence on the underlying firms or not. Therefore, the hypothesis to be tested are as follows:

For the pandemic positive sectors (IT services, edutech, pharmaceutical, insurance, medical equipment and supplies):

Ho: (DMR of the sector) post–pandemic  (DMR of the sector) pre–pandemic

(DMR of the sector) pre–pandemic

H1: (DMR of the sector) post–pandemic > (DMR of the sector) pre–pandemic

where

(DMR of sector j) post–pandemic = MRpost–pandemic for sector j – MR post–pandemic for index

(DMR of sector j) pre–pandemic = MRpre–pandemic for sector j – MR pre–pandemic for index

For the pandemic negative sectors (aviation, hospitality, media, tourism, automotive, retailing):

Ho: (DMR of the sector) post–pandemic  (DMR of the sector) pre–pandemic

(DMR of the sector) pre–pandemic

H1: (DMR of the sector) post–pandemic < (DMR of the sector) pre–pandemic

For the pandemic neutral sector (fast moving consumer goods)

Test 11: Ho: (DMR of the sector) post–pandemic = (DMR of the sector) pre–pandemic

H1: (DMR of the sector) post–pandemic  (DMR of the sector) pre–pandemic

(DMR of the sector) pre–pandemic

Research Methodology

The research methodology can be explained to consist of three key steps as mentioned below:

Step 1: Classification of sectors based on the assumed influence of the pandemic as per the prevailing construct.

Step 2: Validation of the prevailing-construct-based classification with the analysis of the financial statements for each sector.

Step 3: Validating whether the influence of pandemic is reflected in the stock returns.

Discussion on Step 1 (Classification of Sectors Based on the Assumed Influence of the Pandemic as per the Prevailing Construct)

First of all, the sectors were classified based on the prevailing construct for being positively or negatively influenced by the pandemic. This resulted in the following categorisation:

Industries that are assumed to be positively affected by the pandemic

1. Edutech

2. Information technology (IT) services and consulting

3. Life and health insurance

4. Medical equipment, supplies and accessories

5. Pharmaceutical (healthcare)

Industries that are assumed to be negatively affected by the pandemic

1. Automobiles

2. Aviation

3. Film production, distribution and entertainment (media)

4. Hotel, resorts and restaurants (hospitality)

5. Travel services (tourism)

6. Retailing

Industries that are assumed to be not affected by (or neutral to) the pandemic

1. Fast moving consumer goods

Discussion on Step 2 (Validation of the Prevailing-Construct-Based Classification with the Analysis of the Financial Statements for Each Sector)

In this step, the top stocks by market capitalisation from among the NIFTY 50 stocks were selected in each sector. For those sectors that had inadequate representation in NIFTY 50, even the stocks outside NIFTY 50 were selected to have a minimum of three stocks for each of the sectors.

The rationale for using NIFTY 50 as an index is that it has been used by many studies earlier in the field of equity research, some of which are Agarwalla et al. (2021), Dungore and Patel (2021), Shaik and Gulhane (2021) and Parab et al. (2020). Nifty and tertiary sectors are positively related to each other (Swaroop & Mishra, 2018). Since the tertiary sector is the bigger contributor to the India growth story, NIFTY 50 can be considered a true reflection of economic development. Hence, the authors used NIFTY 50 as the index. It has also been established that stocks are a significant indicator of economic development (Atje & Jovanovic, 1993; Caporale et al., 2004; Duca, 2007).

Then, the financial statements of the selected firms in each sector were sourced from moneycontrol.com and analysed to validate the assumed effect of the pandemic. The annual total income and EBITDA of each company was taken from 2017 to 2021. The annual growth rate was computed for the period before the pandemic (FY 2017, 2018, 2019) and the period after the pandemic (FY 2020 and FY 2021). The relevant financial ratios of the sectors were also considered, and the changes in these ratios were studied for the period before and after the pandemic. The weighted average of the growth rate of all the companies in the sample was considered as a proxy of the overall % growth of that whole sector.

This financial analysis of the different sectors is also shown in Tables A2.1, A3.1, A4.1, A5.1, A6.1, A7.1, A8.1, A9.1, A10.1, A11.1, A12.1 and A13.1 in the Annexure. All the values of each company of each sector are shown in the Annexure.

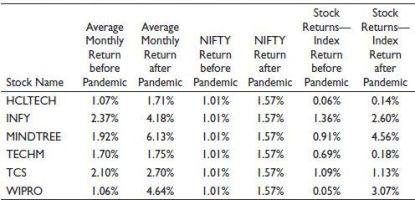

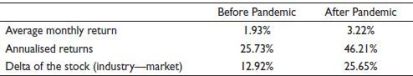

Discussion on Step 3 (Validating whether the Influence of Pandemic Is Reflected in the Stock Returns)

The next step was to find the average stock returns of each firm before and after the pandemic using the stock price trends as obtained from the website moneycontrol.com, and to evaluate if there was any clear indication of influence due to the pandemic. The time series of the stock prices thus obtained was divided into two periods. The period from January 2017 (except for a few stocks that got listed a little later than January 2017) to December 2019 was considered the period before the pandemic, while the one from January 2020 to December 2021 was considered the period after the pandemic. The average monthly stock returns of each firm in these two periods were calculated. Similarly, the average monthly stock returns on the NIFTY were also calculated for both periods. This is also shown in Tables A2.2, A3.2, A4.2, A5.2, A6.2, A7.2, A8.2, A9.2, A10.2, A11.2, A12.2 and A13.2 in the Annexure.

Then, the average monthly stock returns on these firms in each sector were computed using a geometric mean. After this, the difference between the average of the stock returns on each sector and the average of the index returns was computed to assess whether a stock is performing better or worse than the market. The difference (delta) between the average return after the pandemic and before the pandemic of each stock and the market returns was also computed. This is also shown in Tables A2.3, A3.3, A4.3, A5.3, A6.3, A7.3, A8.3, A9.3, A10.3, A11.3, A12.3 and A13.3 in the Annexure.

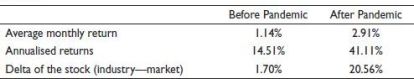

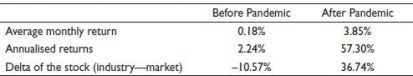

Table A1 captures the difference in the annualised returns on NIFTY 50 before the pandemic and after the pandemic.

Research Findings

This section describes the findings of the three steps followed in the research study as mentioned in the preceding section.

Findings of Step 1 (Classification of Sectors Based on the Assumed Influence of the Pandemic as per the Prevailing Construct)

As discussed in the section Discussion on Step 1 (Classification of Sectors Based on the Assumed Influence of the Pandemic as per the Prevailing Construct), the various sectors in the industry were classified as per the assumed influence of the pandemic on them based on public opinion and prevailing views about how they would be influenced by the pandemic. Table 1 mentions the assumed influence along with the rationale based on the prevailing construct for the different sectors.

Table 1. Assumed Influence of the Pandemic on Different Sectors.

.jpg/10_1177_jiift_221149248-table1(2)__404x480.jpg)

.jpg/10_1177_jiift_221149248-table2(2)__410x600.jpg)

.jpg/10_1177_jiift_221149248-table3(2)__399x600.jpg)

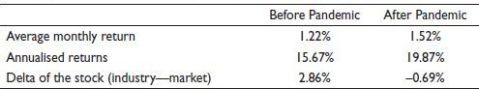

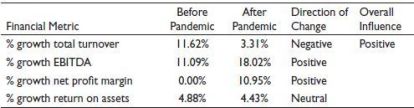

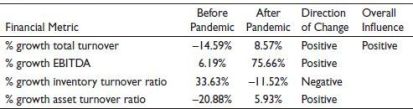

Findings of Step 2 (Validation of the Prevailing-Construct-Based Classification with the Analysis of the Financial Statements for Each Sector)

This section captures the actual impact of the pandemic on the performance of different sectors as measured from the annualised % rate of growth of revenues and EBITDA figures of each sector that were calculated using the financial statements and are shown in Tables A2.1, A3.1, A4.1, A5.1, A6.1, A7.1, A8.1, A9.1, A10.1, A11.1, A12.1 and A13.1 in the Annexure. Table 2 summarises the findings from the tables mentioned above in the Annexure.

Explaining the Rationale behind the Cases of Mismatch between Financial Statements and Prevailing Constructs

Film Production and Distribution. In the year 2020, EROS NOW will have gained 19 million premium paid members and 224 million registered users from over 150 countries across the world to circumvent limitations (BestMediaInfo Bureau, 2021). SAREGAMA India Ltd, a music label, reported a more than twofold rise in consolidated net profit because of the increased digital media consumption during the pandemic’s stay-at-home period (PTI, 2021). UFO Moviez India Limited entered the film distribution business to consolidate and position itself as a one-stop pan-India film distributor. UFO Moviez India Ltd. also partnered with another player in the industry to provide companies throughout the country with influencer marketing, branded content and social media solutions (Exchange4media Staff, 2021). The media and entertainment witnessed a favourable impact on financial accounts due to the reasons stated above.

Life Insurance. The business was mainly suspended because of the businesses’ inability to move their business processes digitally and, therefore, suffered during the initial phase of Covid. Hence, the financial statements show that life and health insurance were negatively impacted by the pandemic. However, companies have been reminded of the significance of customer-centricity as a result of these shifts in consumer thinking. Players have responded quickly, introducing pandemic-specific insurance, plans tailored to client expectations and needs, digital access to services and improved claim settlement procedures. Because many businesses were able to survive and change their businesses digitally during the first phase of Covid, the drop-off in this industry is not significant.

Automobile. Pre-Covid, the expansion of India’s automobile sector was hampered by positive improvements such as GST, the transition to BS6 emission standards (effective 1 April 2020) from BS4, and so on. However, a positive phenomenon happened with the advent of COVID-19. Because social and physical separation will be the norm for some time, a segment of commuters may choose not to use public transportation, resulting in increased demand for personal vehicles, particularly two-wheelers and affordable four-wheelers. Additionally, various government policies, such as the farm bill, which increased tractor manufacturing and production for farmers, prompted many investors to invest, and thus the market grew. Hence, the financial statements show an improvement in performance for this sector since the sector was already struggling before the pandemic and could become more cost-efficient by responding fast to the pandemic.

Table 2. Do Financial Statements Reflect the Assumed Effect of the Pandemic?

.jpg/10_1177_jiift_221149248-table4(1)__780x327.jpg)

Food Processing. With the COVID-19 spread boosting biscuit sales, Britannia, the producer of Good Day, has prioritised the manufacturing of such goods, putting plans to expand its croissant and salty snack options on hold. This has caused a halt in the company’s journey to become a total foods company, and as a result, the market value has dropped slightly, but not dramatically, as the company was able to focus all of its resources on 20% of its products, which generated about 80% revenue during these times and stopped the rest of the product manufacturing (Ahmad, 2020). Domestic sales account for a major percentage of Nestle India’s income, accounting for 94.7% of total revenue in 2020. While domestic sales climbed by 8.5% year over year in 2020, the Covid-19 lockdown had a negative influence on performance in the June quarter, with sales only increasing by 2.6%. As a result, domestic sales grew by 10% to 11% year over year in the last three quarters. In comparison to the previous year, the total domestic volume for 2020 grew by 5.7%. E-share commerce’s domestic sales have risen to 3.7% in 2020, up from 0.6% in 2016. While COVID had an impact on Nestle India, causing a drop in its stock price, it did not have a significant impact because of its online meal delivery system, which witnessed significant growth in its numbers and orders. Because there was such a high demand for packaged and processed foods during the pandemic, many companies producing them were able to sell large quantities of their products at once, increasing their revenue and market share. Additionally, because these companies had limited product differentiation, their resources were not depleted. Hence, the food processing industry in India was positively impacted by the pandemic as shown by the financial statements.

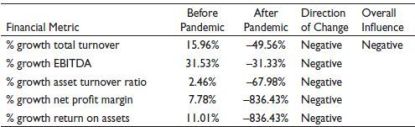

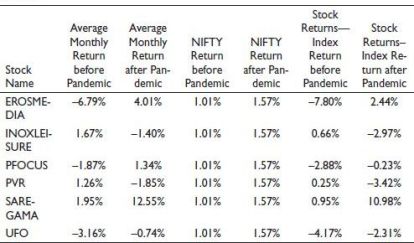

Findings of Step 3 (Validating whether the Influence of Pandemic Is Reflected in the Stock Returns)

This is according to the delta of the market return (industry annual return—market annual return) which is also shown in the Annexure.

Table 3 captures the findings of step 3 to validate the effect of pandemic on stock market returns.

Table 3. Do Stock Market Returns Reflect the Assumed Effect of the Pandemic?

.jpg/10_1177_jiift_221149248-table5(1)__416x158.jpg)

.jpg/10_1177_jiift_221149248-table6(1)__425x600.jpg)

.jpg/10_1177_jiift_221149248-table7(1)__416x83.jpg)

Hypothesis Testing

This is according to the delta of the stock return and market return before and after pandemic, which is also shown in the Annexure.

Implications of the Study for Managers and Investors

Retail investors, investment bankers, fund managers and financial consultants need to optimise the returns on their investments. Fundamental research is many times resorted to by them to devise their portfolio strategies. The basic premise behind the fundamental analysis is that the financial statements are the mirror of the firm’s performance in the dynamic macroeconomic scenario. However, if the effect of the contemporary happenings is not incorporated in the stock market prices, it leads to market inefficiencies as well as improper allocation of the investor funds to the industry. In the long run, it may lead to erosion of investor confidence and thereby a failure of the capital markets. Thus, the fundamental analysis will not enable making the right investing decisions if the stock market returns do not reflect the contemporary business happenings.

Considering this, the research study has played an important role in establishing that the stock market returns are a reflection of the business realities at an overall level. That serves as a relief for the investing community and reinforces the fact that the stock fundamentals in the context of the macroeconomic scenario do matter and cannot be ignored while making business decisions.

But at the same time, this research study also cautions them to consider the business’ prospective performance in its entirety while investing in the equity markets. For example, this study had observed many exceptions and explained the rationale behind them. For example, a few of the media and entertainment industry was able to better contrary to the popular opinion because they adopted the digital chord well on time. Similarly, the automotive industry was an exception to the popular opinion because it was already in the doldrums before the advent of the pandemic and was able to bring in resource efficiencies during the pandemic resulting in EBITDA improvements.

Table 4 reflects the findings of paired t-test conducted on stock returns to check the various hypotheses defined in the study.

Table 4. Findings of Paired t-Test Conducted on Stock Returns to Check the Hypothesis.

.jpg/10_1177_jiift_221149248-table8(1)__376x600.jpg)

.jpg/10_1177_jiift_221149248-table9(1)__391x480.jpg)

It can also be observed that there is some inconsistency between the findings obtained from hypothesis testing on stock returns and those from weighted average stock returns. This is because the t-tests give equal weightage to all the observations irrespective of the size of the firm represented by the stock.

Thus, from the findings, it can be inferred that the stock market returns have captured the influence of the pandemic on the sector for most of the sectors. The reasons for the exceptions have been explored and proposed, except in the case of the tourism sector, where any suitable reasoning could not be found.

Conclusions

This research study has an important achievement of validating the influence of the pandemic’s business effects on the stock market returns on an overall basis. The study is quite robust since the major stocks by market capitalisation, which can be considered as a good proxy of the respective sectors of Indian economy, have been considered.

However, there are a few limitations of the study. First, there may be a few large players that are not listed in the equity market or have no significant market capitalisation, but they are a player of sizeable size when it comes to the value of the firm. Such firms could have been ignored in this study. Second, while determining the overall stock returns for any sector, the weighted average of the individual stock returns has been computed with weights being the proportion of the market capitalisation of those stocks. But the market capitalisation of the listed stocks may not always be a correct proxy of the relative size of a business. Third, while evaluating the financial performance of the businesses pre- and post-pandemic, the standalone financial statements were not available for a few businesses that are diversified conglomerates. In such cases, it has been assumed that the consolidated financial statements reflect the performance of the standalone business, which may not always be true.

This study can be extended in many directions in the future. First, the parallels can be drawn between the findings of this study and similar studies on the earlier financial busts such as the dot-com crash and the subprime crisis. In addition, an analytical comparison can be done on whether the ability of a financial crisis to influence the stock market returns is also related to the nature of the crisis.

Second, this study was limited to only NIFTY 50 stocks, while it can be carried out on a larger sample of stocks from each industry so that the sampling errors can be eliminated, as the standard error of the sampling distribution with fall with a larger sample.

Third, the different sectors may exhibit varying levels of business cyclicity. Irrespective of whether the cyclicity is positive or negative, it may be of different extent for not only different sectors but also for the different firms within each sector. If a study can be done to gauge the pandemic’s influence on stock market returns in the context of cyclicity, it can help draw more insights.

Fourth, if the resilience of the sectors or the businesses to the financial crisis can also be measured and brought into consideration, some important insights can be drawn on whether the ability of a macroeconomic situation to influence the stock returns is dependent on the resilience of that business or not.

Thus, this research study has been quite conclusive, but it also has many limitations and possible directions of extension in the future, which can be pursued to enhance the existing body of knowledge on the behaviour of equity market returns.

Annexure

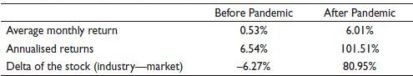

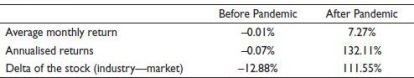

Table A1. Summary of Stock Returns on NIFTY.

.jpg/10_1177_jiift_221149248-table10(1)__480x88.jpg)

Table A2.1. Financial Statement Analysis of Selected Stocks in the Indian Automotive Industry.

.jpg/10_1177_jiift_221149248-table11(1)__480x146.jpg)

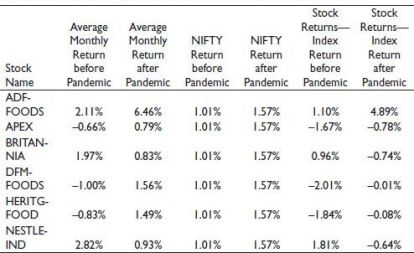

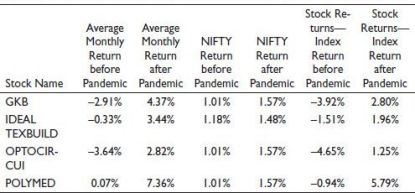

Table A2.2. DMR for Indian Automotive Stock Returns and Market Returns.

.jpg/10_1177_jiift_221149248-table12(1)__480x292.jpg)

Table A2.3. Premium of Indian Automotive Stock Returns over the Index Returns.

.jpg/10_1177_jiift_221149248-table13(1)__480x88.jpg)

Table A3.1. Financial Statement Analysis of Selected Stocks in the Indian Aviation Industry.

.jpg/10_1177_jiift_221149248-table14(1)__480x149.jpg)

Table A3.2. DMR for Indian Aviation Stock Returns and Market Returns.

.jpg/10_1177_jiift_221149248-table15(1)__480x165.jpg)

Table A3.3. Premium of Indian Aviation Stock Returns over the Index Returns.

Table A4.1. Financial Statement Analysis of Selected Stocks in the Indian Media Industry.

Table A4.2. DMR for Indian Media and Entertainment Stock Returns and Market Returns.

Table A4.3. Premium of Indian Media and Entertainment Stock Returns over the Index Returns.

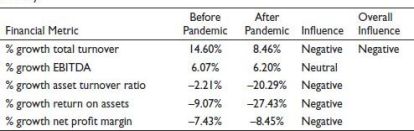

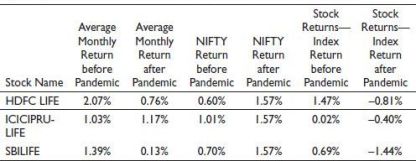

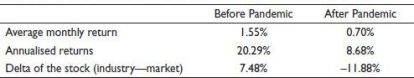

Table A5.1. Financial Statement Analysis of Selected Stocks in the Indian Insurance Industry.

Table A5.2. DMR for Indian Insurance Stock Returns and Market Returns.

Table A5.3. Premium of Indian Insurance Stock Returns over the Index Returns.

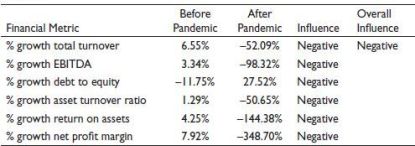

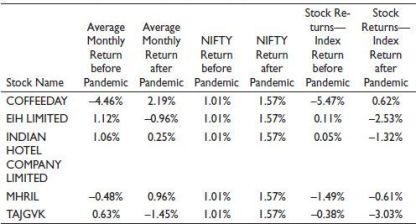

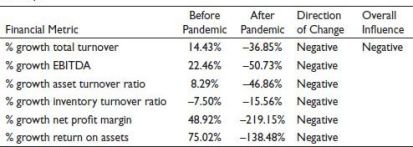

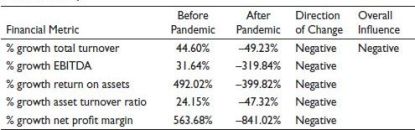

Table A6.1. Financial Statement Analysis of Selected Stocks in the Indian Hospitality Industry.

Table A6.2. DMR for Indian Hospitality Stock Returns and Market Returns.

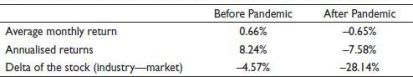

Table A6.3. Premium of Indian Hospitality Stock Returns over the Index Returns.

Table A7.1. Financial Statement Analysis of Selected Stocks in the Indian Retail Industry.

Table A7.2. DMR for Indian Retail Stock Returns and Market Returns.

Table A7.3. Premium of Indian Retail Stock Returns over the Index Returns.

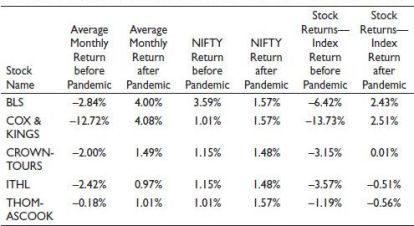

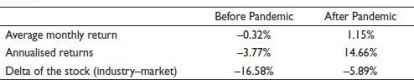

Table A8.1. Financial Statement Analysis of Selected Stocks in the Indian Travel and Tourism Industry.

Table A8.2. DMR for Indian Travel and Tourism Stock Returns and Market Returns.

Table A8.3. Premium of Indian Travel and Tourism Stock Returns over the Index Returns.

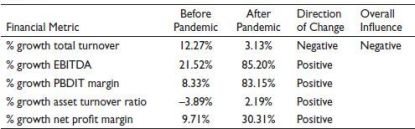

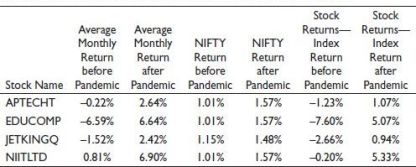

Table A9.1. Financial Statement Analysis of Selected Stocks in the Indian FMCG Industry.

Table A9.2. DMR for Indian FMCG Stock Returns and Market Returns.

Table A9.3. Premium of Indian FMCG Stock Returns over the Index Returns.

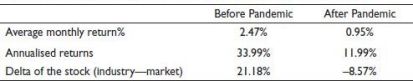

Table A10.1. Financial Statement Analysis of Selected Stocks in the Indian Edutech Industry.

Table A10.2. DMR for Indian Edutech Stock Returns and Market Returns.

Table A10.3. Premium of Indian Edutech Stock Returns over the Index Returns.

Table A11.1. Financial Statement Analysis of Selected Stocks in the Indian IT Services Industry.

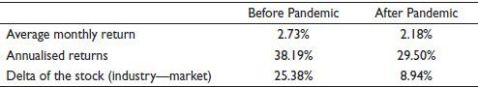

Table A11.2. DMR for Indian IT Services Stock Returns and Market Returns.

Table A11.3. Premium of Indian IT Services Industry Stock Returns over the Index Returns.

Table A12.1. Financial Statement Analysis of Selected Stocks in the Indian Medical Equipment Industry.

Table A12.2. DMR for Indian Medical Equipment Stock Returns and Market Returns.

Table A12.3. Premium of Indian Medical Supplies Industry Stock Returns over the Index Returns.

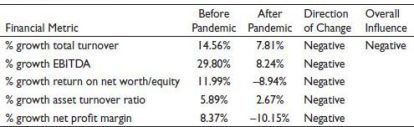

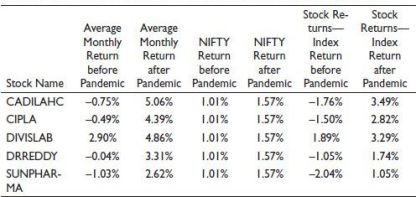

Table A13.1. Financial Statement Analysis of Selected Stocks in the Indian Pharmaceutical Industry.

Table A13.2. DMR for Indian Pharmaceutical Stock Returns and Market Returns.

Table A13.3. Premium of Indian Pharmaceutical Stock Returns over the Index Returns.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

Abu-Rayash, A., & Dincer, I. (2020). Analysis of mobility trends during the COVID-19 coronavirus pandemic: Exploring the impacts on global aviation and travel in selected cities. Energy Research and Social Science, 68, 101693. https://doi.org/10.1016/j.erss.2020.101693

Agarwalla, S. K., Varma, J. R., & Virmani, V. (2021). The impact of COVID-19 on tail risk: Evidence from Nifty index options. Economics Letters, 204, 109878. https://doi.org/10.1016/j.econlet.2021.109878

Agrawal, A. (2020). Sustainability of airlines in India with COVID-19: Challenges ahead and possible way-outs. Journal of Revenue and Pricing Management, 20(3), 457–472. https://doi.org/10.1057/s41272-020-00257-z

Ahmad, S. (2020, June 3). COVID-19 slows Britannia’s total foods journey as biscuits get priority. Business Standard. https://www.business-standard.com/article/companies/covid-19-slows-britannia-s-total-foods-journey-as-biscuits-get-priority-120060301380_1.html

Alipour, M. (2012). The effect of intellectual capital on firm performance: An investigation of Iran insurance companies. Measuring Business Excellence, 16(1), 53–66. https://doi.org/10.1108/13683041211204671

Ammirato, S., Linzalone, R., & Felicetti, A. M. (2021). Business model innovation drivers as antecedents of performance. Measuring Business Excellence, 26(1), 6–22. https://doi.org/10.1108/MBE-01-2021-0012

Atje, R., & Jovanovic, B. (1993). Stock markets and development. European Economic Review, 37(2–3), 632–640.

Bai, C., Quayson, M., & Sarkis, J. (2021). COVID-19 pandemic digitization lessons for sustainable development of micro and small enterprises. Sustainable Production and Consumption, 27, 1989–2001. https://doi.org/10.1016/j.spc.2021.04.035

Bartik, A. W., Bertrand, M., Cullen, Z., Glaeser, E. L., Luca, M., & Stanton, C. (2020). The impact of COVID-19 on small business outcomes and expectations. Economic Sciences, 117(30), 17656–17666.

BestMediaInfo Bureau. (2021, June 21). Eros India restructures its operations for future growth. BestMediaInfo. https://bestmediainfo.com/2021/06/eros-india-restructures-its-operations-for-future-growth/

Borio, C. (2020). The COVID-19 economic crisis: Dangerously unique. Business Economics, 55(4), 181–190. http://doi.org/10.1057/s11369-020-00184-2

Business Wire. (2020, April 22). Impact of COVID-19 on the aviation industry. https://www.businesswire.com/news/home/20200422005684/en/Impact-of-COVID-19-on-the-Aviation-Industry-2020-Historical-Market-Growth-Estimations-and-Deviations-in-the-Growth-Rate-Post-COVID-19-Pandemic---ResearchAndMarkets.com

Calandro, J. Jr., & Lane, S. (2006). An introduction to the enterprise risk scorecard. Measuring Business Excellence, 10(3), 31–40. https://doi.org/10.1108/13683040610685775

Caporale, G. M., Howells, P. G., & Soliman, A. M. (2004). Stock market development and economic growth: A casual linkage. Journal of Economic Development, 29(1), 33–50. https://ideas.repec.org/a/jed/journl/v29y2004i1p33-50.html

Casale, P. N., Vyavahare, M., Coyne, S., Kronish, I., Greenwald, P., Ye, S., Deland, E., & Fleischut, P. M. (2021). The promise of remote patient monitoring: Lessons learned during the COVID-19 surge in New York City. American Journal of Medical Quality, 36(3), 139–144. https://doi.org/10.1097/01.JMQ.0000741968.61211.2b

Chaudhary, M., Sodani, P. R., & Das, S. (2020). Effect of COVID-19 on economy in India: Some reflections for policy and programme. Journal of Health Management, 22(2), 169–180. https://doi.org/10.1177/0972063420935541

Chu, E. L. (1997). Impact of earnings, dividends and cash flows on stock returns: Case of Taiwan’s stock market. Review of Quantitative Finance and Accounting, 9(2), 181–202.

Crespí-Cladera, R., Martín-Oliver, A., & Pascual-Fuster, B. (2021). Financial distress in the hospitality industry during the COVID-19 disaster. Tourism Management, 85, 104301. https://doi.org/10.1016/j.tourman.2021.104301

Dam?a, C., Langford, M., Uehara, D., & Scherer, R. (2021). Teachers’ agency and online education in times of crisis. Computers in Human Behavior, 121, 106793. https://doi.org/10.1016/j.chb.2021.106793

Dash, G., & Chakraborty, D. (2021). Digital transformation of marketing strategies during a pandemic: Evidence from an emerging economy during COVID-19. Sustainability, 13(12), 6735. https://doi.org/10.3390/su13126735

Dinh, H. B. P., & Narayan, P. K. (2020). Country responses and the reaction of the stock market to COVID-19—A preliminary exposition. Emerging Markets Finance and Trade, 56(10), 2138–2150. https://doi.org/10.1080/1540496X.2020.1784719

Douglas, S. (2021). Building organizational resilience through human capital management strategy. Development and Learning in Organizations, 35(5), 19–21. https://doi.org/10.1108/DLO-08-2020-0180

Duca, G. (2007). The relationship between the stock market & the economy: Experience from international financial markets. Bank of Valletta a Review, 36(3), 1–12.

Dungore, P. P., & Patel, S. H. (2021). Analysis of volatility volume and open interest for Nifty index futures using GARCH analysis and VAR model. International Journal of Financial Studies, 9(1), 1–11. https://doi.org/10.3390/ijfs9010007

Exchange4media Staff. (2021, April 28). UFO Moviez, The Collective Artists Network to offer content & social media solutions. e4m. https://www.exchange4media.com/marketing-news/ufo-moviez-the-collective-artists-network-to-offer-content-social-media-solutions-112632.html

Farooq, R., Vij, S., & Kaur, J. (2021). Innovation orientation and its relationship with business performance: Moderating role of firm size. Measuring Business Excellence, 25(3), 328–345. https://doi.org/10.1108/MBE-08-2020-0117

FE Bureau. (2020, April 6). COVID-19’s impact on insurance: Demand for health and life plans set to spike. Financial Express. https://www.financialexpress.com/money/insurance/covid-19s-impact-on-insurance-demand-for-health-and-life-plans-set-to-spike/1918434/

Feroz, A. S., Khoja, A., & Saleem, S. (2021). Equipping community health workers with digital tools for pandemic response in LMICs. Archives of Public Health, 79, Article 1. https://doi.org/10.1186/s13690-020-00513-z

GEP. (2020). GEP outook 2020: Business and economic realities in a post-covid era, a market research report. https://www.gep.com/white-papers/procurement-and-supply-chain-outlook-report-2020

Harris, T. F., Yelowitz, A., & Courtemanche, C. (2021). Did COVID-19 change life insurance offerings? Journal of Risk and Insurance, 88(4), 831–861. https://doi.org/10.1111/jori.12344

He, Q., Liu, J., Wang, S., & Yu, J. (2020). The impact of COVID-19 on stock markets. Economic and Political Studies, 8(3), 275–288. https://doi.org/10.1080/20954816.2020.1757570

Hoque, M. E., & Yakob, N. A. (2017). Revisiting stock market development and economic growth nexus: The moderating role of foreign capital inflows and exchange rates. Cogent Economics & Finance, 5(1), Article 1329975. https://doi.org/10.1080/23322039.2017.1329975

Ibarra-Cisneros, M.-A., & Hernandez-Perlines, F. (2020). Entrepreneurial orientation, absorptive capacity and business performance in SMEs. Measuring Business Excellence, 24(4), 417–429. https://doi.org/10.1108/MBE-09-2019-0091

India Infoline News Service. (2020). UFO Moviez gains 2% after announcing foray into film distribution. https://www.indiainfoline.com/article/news-top-story/ufo-moviez-gains-2-after-announcing-foray-into-film-distribution-120122200252_1.html

Li, C., & Lalani, F. (2020, April 29). The COVID-19 pandemic has changed education forever. This is how. World Economic Forum. https://www.weforum.org/agenda/2020/04/coronavirus-education-global-covid19-online-digital-learning/

Mafabi, S., Munene, J. C., & Ahiauzu, A. (2015). Creative climate and organisational resilience: The mediating role of innovation. International Journal of Organizational Analysis, 23(4), 564–587. https://doi.org/10.1108/IJOA-07-2012-0596

Maitra, B. C. (2021, February). A bright future for life insurance in India in a post-pandemic world. ArthurDLittle. https://www.adlittle.de/en/insights/report/bright-future-life-insurance-india-post-pandemic-world

Maity, S., Sahu, T. N., & Sen, N. (2021). Panoramic view of digital education in COVID-19: A new explored avenue. Review of Education, 9(2), 405–423.

Mandal, S., & Dubey, R. K. (2021). Effect of inter-organizational systems appropriation in agility and resilience development: An empirical investigation. Benchmarking: An International Journal, 28(9), 2656–2681. https://doi.org/10.1108/BIJ-10-2020-0542

Market Data Forecast. (2020, April 8). Impacts of COVID-19 on the Information Technology (IT) industry. https://www.marketdataforecast.com/blog/impacts-of-covid19-on-information-technology-industry

Matalamaki, M. J., & Joensuu-Salo, S. (2021). Digitalization and strategic flexibility—A recipe for business growth. Journal of Small Business and Enterprise Development, 29(3), 380–401. https://doi.org/10.1108/JSBED-10-2020-0384

Meticulous Market Research Pvt. Ltd. (2020, May 11). COVID-19 impact on automotive industry—Meticulous research viewpoint. GlobeNewswire. https://www.globenewswire.com/news-release/2020/05/11/2031169/0/en/COVID-19-Impact-on-Automotive-Industry-Meticulous-Research-Viewpoint.html

Milenkova, V., & Lendzhova, V. (2021). Digital citizenship and digital literacy in the conditions of social crisis. Computers, 10(4), 40. https://doi.org/10.3390/computers10040040

Mirza, A., Malek, M., & Abdul-Hamid, M. A. (2019). Value relevance of financial reporting: Evidence from Malaysia. Cogent Economics & Finance, 7(1). https://doi.org/10.1080/23322039.2019.1651623

Mobin, M. A., Hassan, M. K., Khalid, A., & Abdul-Rahim, R. (2022). COVID-19 pandemic and risk dynamics of financial markets in G7 countries. International Journal of Islamic and Middle Eastern Finance and Management, 15(2), 461–478. https://doi.org/10.1108/IMEFM-09-2021-0358

Mohanram, P. S. (2005). Separating winners from losers among low book-to-market stocks using financial statement analysis. Review of Accounting Studies, 10(2–3), 133–170. https://doi.org/10.1007/s11142-005-1526-4

Moustaghfir, K. (2008). The dynamics of knowledge assets and their link with firm performance. Measuring Business Excellence, 12(2), 10–24. https://doi.org/10.1108/13683040810881162

Mroz, F. (2021). The impact of COVID-19 on pilgrimages and religious tourism in Europe during the first six months of the pandemic. Journal of Religion and Health, 60(2), 625–645. https://doi.org/10.1007/s10943-021-01201-0

Nadeem, M., Gan, C., & Nguyen, C. (2017). Does intellectual capital efficiency improve firm performance in BRICS economies? A dynamic panel estimation. Measuring Business Excellence, 21(1), 61–85. https://doi.org/10.1108/MBE-12-2015-0055

Naeem, M. (2021). Understanding the customer psychology of impulse buying during COVID-19 pandemic: Implications for retailers. International Journal of Retail & Distribution Management, 49(3), 377–393. https://doi.org/10.1108/IJRDM-08-2020-0317

Navas, R. D., Bentes, S. R., & Gama, A. M. (2016). Evaluating companies: Investing for the long run. In O. Gomes & H. F. Martins (Eds.), Advances in applied business research: The L. A. B. S. initiative (pp. 72–82). Nova Science Publishers.

Nguyen, N. H., Nguyen, A. Q., Ha, V. T. B., Duong, P. X., & van Nguyen, T. (2021). Using emerging telehealth technology as a future model in Vietnam during the COVID-19 pandemic: Practical experience from Phutho General Hospital. JMIR Formative Research, 5(6). https://doi.org/10.2196/27968

Nikookar, E., & Yanadori, Y. (2022). Preparing supply chain for the next disruption beyond COVID-19: Managerial antecedents of supply chain resilience. International Journal of Operations & Production Management, 42(1), 59–90. https://doi.org/10.1108/IJOPM-04-2021-0272

OECD. (2020, June 16). COVID-19 and the retail sector: Impact and policy responses. https://www.oecd.org/coronavirus/policy-responses/covid-19-and-the-retail-sector-impact-and-policy-responses-371d7599/

Ozili, P. (2020). COVID-19 in Africa: Socio-economic impact, policy response and opportunities. International Journal of Sociology and Social Policy, 42(3/4), 177–200. https://doi.org/10.1108/IJSSP-05-2020-0171

Panigrahi, R. R., Jena, D., Meher, J. R., & Shrivastava, A. K. (2022). Assessing the impact of supply chain agility on operational performances—A PLS-SEM approach. Measuring Business Excellence, 27(1), 1–24. https://doi.org/10.1108/MBE-06-2021-0073

Parab, N., Naik, R., & Reddy, Y. V. (2020). The impact of economic events on stock market returns: Evidence from India. Asian Economic and Financial Review, 10(11), 1232–1247. https://doi.org/10.18488/journal.aefr.2020.1011.1232.1247

Park, H., Kim, T. S., & Park, Y. J. (2021). Asymmetric information in the equity market and information flow from the equity market to the CDS market. Journal of Financial Markets, 55, 100607. https://doi.org/10.1016/j.finmar.2020.100607

Pillai, S. G., Haldorai, K., Seo, W. S., & Kim, W. G. (2021). COVID-19 and hospitality 5.0: Redefining hospitality operations. International Journal of Hospitality Management, 94, 102869. https://doi.org/10.1016/j.ijhm.2021.102869

Piotroski, J. D. (2000). Value investing: The use of historical financial statement information to separate winners from losers. Journal of Accounting Research, 38, 1–41, https://doi.org/10.2307/2672906

Pratono, A. H. (2021). Reinterpreting excellence for sustainable competitive advantage: The role of entrepreneurial culture under information technological turbulence. Measuring Business Excellence, 23(2), 180–196. https://doi.org/10.1108/MBE-04-2021-0056

PTI. (2021, May 12). Saregama India Q4 results: Profit rises over two-folds to Rs 37.18 crore. The Economic Times. https://economictimes.indiatimes.com/markets/stocks/earnings/saregama-india-q4-results-profit-rises-over-two-folds-to-rs-37-18-crore/articleshow/82574504.cms?from=mdr

Rakshit, B., & Neog, Y. (2021). Effects of the COVID-19 pandemic on stock market returns and volatilities: Evidence from selected emerging economies. Studies in Economics and Finance, 39(4), 549–571. https://doi.org/10.1108/SEF-09-2020-0389

Riyazahmed, K. (2021). Investment motives and preferences—An empirical inquiry during COVID-19. Investment Management and Financial Innovations, 18(2), 1–11. https://doi.org/10.21511/imfi.18(2).2021.01

Robinson, J. C. (2021). Funding of pharmaceuticalinnovation during and after the COVID-19 pandemic. JAMA, 325(9), 825–826. doi: 10.1001/jama.2020.25384

Salisu, A. A., Adediran, I. A., & Gupta, R. (2022). A note on the COVID-19 shock and real GDP in emerging economies. Emerging Markets Finance and Trade, 58(1), 93–101. https://doi.org/10.1080/1540496X.2021.1981854

Shaik, M., & Gulhane, R. D. (2021). Power of moment-based normality tests: Empirical analysis on Indian stock market index. International Journal of Finance and Economics. https://doi.org/10.1002/ijfe.2579

Sharma, A., Shin, H., Santa-María, M. J., & Nicolau, J. L. (2021). Hotels’ COVID-19 innovation and performance. Annals of Tourism Research, 88, 103180. https://doi.org/10.1016/j.annals.2021.103180

Shekhar, M. (2020, April 29). COVID-19 impact explained: How India’s film industry got hit and is preparing for a new normal. The Indian Express. https://indianexpress.com/article/explained/explained-how-will-coronavirus-impact-entertainment-industry-6370412/

Shetty, G., Nougarahiya, S., Mandloi, D., Sarsodia, T., & Dabade, S. J. (2020). COVID-19 and Indian commerce: An analysis of fast moving consumer goods (FMCG), and retail industries of tomorrow. International Journal of Current Research and Review, 12(17), 23–31.

Silva, E. S., & Bonetti, F. (2021). Digital humans in fashion: Will consumers interact? Journal of Retailing and Consumer Services, 60, 102430. https://doi.org/10.1016/j.jretconser.2020.102430

Singh, R. P., Haleem, A., Javaid, M., Kataria, R., & Singhal, S. (2021). Cloud computing in solving problems of COVID-19 pandemic. Journal of Industrial Integration and Management, 6(2), 209–219. https://doi.org/10.1142/S2424862221500044

Skare, M., Soriano, D. R., & Porada-Rocho?, M. (2021). Impact of COVID-19 on the travel and tourism industry. Technological Forecasting and Social Change, 163, 120469. https://doi.org/10.1016/j.techfore.2020.120469

Sukharev, O. S. (2020). Economic crisis as a consequence COVID-19 virus attack: Risk and damage assessment. Quantitative Finance and Economics, 4(2), 274–293. https://doi.org/10.3934/QFE.2020013

Sun, X., Wandelt, S., Zheng, C., & Zhang, A. (2021). COVID-19 pandemic and air transportation: Successfully navigating the paper hurricane. Journal of Air Transport Management, 94. https://doi.org/10.1016/j.jairtraman.2021.102062

Sundar, S. (2021, May 17). ITC may be a Beneficiary of India’s COVID lockdowns like all other FMCG companies. Investing.com. https://in.investing.com/analysis/itc-may-be-a-beneficiary-of-indias-covid-lockdowns-like-all-other-fmcg-companies-200474750

Swaroop, S., & Mishra, A. K. (2018). Either the NSE nifty a barometer of tertiary sector growth in India or vice versa: An empirical analysis. Journal of Advanced Research in Dynamical and Control Systems, 10(4), 335–341.

Toubes, D. R., Vila, N. A., & Fraiz Brea, J. A. (2021). Changes in consumption patterns and tourist promotion after the COVID-19 pandemic. Journal of Theoretical and Applied Electronic Commerce Research, 16(5), 1332–1352. https://doi.org/10.3390/jtaer16050075

U?ur, N. G., & Akb?y?k, A. (2020). Impacts of COVID-19 on global tourism industry: A cross-regional comparison. Tourism Management Perspectives, 36. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7474895/

Verma, R. K., Kumar, A., & Bansal, R. (2021). Impact of COVID-19 on different sectors of the economy using event study method: An Indian perspective. Journal of Asia-Pacific Business, 22(2), 109–120. https://doi.org/10.1080/10599231.2021.1905492

Waal, A. (2021). The high performance organization: Proposed definition and measurement of its performance. Measuring Business Excellence, 25(3), 300–314. https://doi.org/10.1108/MBE-04-2020-0064

Wu, G., Yang, B., & Zhao, N. (2020). Herding behavior in Chinese stock markets during COVID-19. Emerging Markets Finance and Trade, 56(15), 3578–3587. https://doi.org/10.1080/1540496X.2020.1855138

Xu, D., Guo, Y., & Huang, M. (2021). Can artificial intelligence improve firms’ competitiveness during the COVID-19 pandemic: International evidence. Emerging Markets Finance and Trade, 57(10), 2812–2825. https://doi.org/10.1080/1540496X.2021.1899911