1Institute for South Asian, West Asian and African Studies, Dong Da, Hanoi, Vietnam

Creative Commons Non Commercial CC BY-NC: This article is distributed under the terms of the Creative Commons Attribution-NonCommercial 4.0 License (http://www.creativecommons.org/licenses/by-nc/4.0/) which permits non-Commercial use, reproduction and distribution of the work without further permission provided the original work is attributed.

Singapore is among India’s most significant trade and investment partners in the Association of Southeast Asian Nations (ASEAN). Bilateral economic exchanges have expanded strongly in recent decades, especially after the conclusion of the India–Singapore Comprehensive Economic Cooperation Agreement (CECA) in 2005. The role and position of Singapore have been increasingly affirmed in its relationship with India since India launched the Look East Policy in 1991 and upgraded it to the Act East Policy in 2014. It has good trade and investment relationships, and Singapore acts as a gateway and bridge connecting India with other ASEAN countries. In this study, the authors analyse the two countries’ existing cooperation mechanisms and frameworks, and the results of trade and investment between them.

India, Singapore, trade, investment, Act East Policy

Introduction

Trade and investment ties between India and Singapore have thrived over the past three decades, particularly within India’s Act East Policy framework. Initially launched in the early 1990s as the Look East Policy and later upgraded to the Act East Policy in 2014, this policy aims to strengthen economic, strategic and cultural ties with Southeast Asian countries, with Singapore being one of the most important strategic partners. With its strategic position as Asia’s leading financial centre, Singapore has become an attractive destination for Indian businesses seeking opportunities to expand into international markets. The two countries have established strong trade and investment relations driven by numerous bilateral agreements. The signing of the India–Singapore Comprehensive Economic Cooperation Agreement (CECA) in 2005 marked a significant milestone, providing a legal foundation for promoting trade in goods (TIG), services and investment between the two nations.

The close relationship between India and Singapore has its roots in solid ties of trade, culture and people-to-people connections that span over a millennium. The more modern aspect of this relationship is often attributed to Sir Stamford Raffles, who established a trading post in Singapore in 1819 along the Strait of Malacca, which later became a British crown colony and administered Kolkata until 1867. These colonial-era linkages entrench the use of English, shape administrative practices and support the presence of an Indian community in Singapore. Following Singapore’s independence in 1965, India was among the earliest countries to extend diplomatic recognition.

The end of the Cold War and India’s balance of payments crisis in 1991 created strong incentives for New Delhi to recalibrate its external economic strategy. The collapse of the Soviet Union reduced India’s traditional economic and political anchor, while the crisis underscored the limitations of a state-led, import-substitution industrialisation model. Economic reforms and gradual liberalisation were therefore combined with an external reorientation towards dynamic Asian economies. In this context, Indian Prime Minister P. V. Narasimha Rao introduced the ‘Look East Policy’ to strengthen political and economic cooperation with the Association of Southeast Asian Nations (ASEAN) region, and Singapore quickly emerged as one of India’s most responsive partners.

The relationship between India and Singapore is based on shared values, common approaches, economic opportunities and a convergence of interests on critical issues. The two sides maintain close political dialogue and defence cooperation, have steadily broadened their economic and technological partnership, and nurture extensive cultural and people-to-people linkages. Their interaction is structured through more than 20 standing mechanisms, ranging from high-level dialogues and ministerial forums to regular military exercises and sectoral working groups. Both countries converge on many international issues and are members of several forums, including the East Asia Summit, G20, Commonwealth of Nations, Indian Ocean Rim Association (IORA) and Indian Ocean Naval Symposium (IONS), which helps align their positions on key international and maritime issues.

India’s Act East Policy represents a significant shift in the country’s foreign policy strategy. It marks a major paradigm shift, reflecting a strategic reorientation towards East and Southeast Asia. The Act East Policy has emerged as an essential diplomatic initiative and a crucial driving force in India’s foreign relations.

Trade and Investment Cooperation Framework Between India and Singapore

The substantial growth in India–Singapore trade and investment has been underpinned by a comprehensive set of bilateral and regional cooperation frameworks. These frameworks and mechanisms create a favourable environment for businesses from both countries and play a crucial role in promoting bilateral economic development. The agreements signed between India and Singapore reflect the increasing overall cooperation, providing a broader framework for government-to-government interactions and trade and investment exchanges. Essential trade and investment cooperation frameworks between India and Singapore include the CECA (2005), the Double Taxation Avoidance Agreement (DTAA) (1994, with an amended protocol in 2011), the India–Singapore Strategic Partnership Framework (2015), the cooperation in the FinTech sector (2018), and the FinTech Cooperation Agreement between the Monetary Authority of Singapore (MAS) and the International Financial Services Centres Authority (IFSCA). In addition to these primary instruments, cooperation has been strengthened through sector-specific agreements in strategic areas, as well as through regular economic summits and institutionalized policy dialogues that support coordination and implementation. At the regional level, the ASEAN–India Free Trade Agreement (AIFTA), signed in 2009, and particularly its Trade in Goods (TIG) Agreement, has significantly influenced trade and investment linkages between India and Singapore.

India–Singapore CECA

The CECA between India and Singapore, signed in 2005, is one of the most significant frameworks in the trade and investment relationship between the two countries. CECA consists of 16 chapters, addressing key issues such as TIG, rules of origin, customs cooperation, mutual recognition agreements on standards and technical regulations, as well as food safety and sanitary measures, investment protection, trade in services, air services, movement of natural persons, e-commerce, intellectual property rights (IPR), science and technology, education, communication, dispute settlement and implementation procedures.

CECA between India and Singapore has four main components. First, it establishes a free trade area for goods with a phased tariff reduction and elimination schedule. Second, it liberalises and disciplines trade in services by offering improved market access and national treatment commitments. Third, it creates a more protective and predictable framework for cross-border investment, including standards on expropriation, dispute settlement and investor rights. Fourth, it links these commitments to tax cooperation through the DTAA, thus mitigating the risk of double taxation and encouraging cross-border capital flows.

TIG

CECA has reduced tariffs on various goods, facilitating easier import and export between the two ountries. As a result, Indian products such as chemicals, petroleum and machinery have gained more accessible access to the Singaporean market, and vice versa.

Trade in Services

The agreement has expanded opportunities for Indian and Singaporean service companies in finance, education and professional services. This enhances trade exchanges and fosters collaboration in high-value-added service sectors.

Investment

CECA include provisions for investment protection and encourages businesses to invest in each other’s countries, creating a stable and reliable investment environment. Singaporean companies have invested significantly in sectors such as real estate, information technology (IT) and infrastructure development in India.

DTAA

The DTAA is a written agreement between two countries to ensure that their residents are not taxed twice on the same income in different countries. The DTAA between India and Singapore provides tax benefits to residents of both countries, improving bilateral relations.

India–Singapore Strategic Partnership Framework

In 2015, during the Indian Prime Minister Narendra Modi’s visit to Singapore to mark the 50th anniversary of diplomatic relations, the two countries decided to elevate their relationship to a Strategic Partnership. Prime Minister Narendra Modi and Singaporean Prime Minister Lee Hsien Loong signed a Joint Declaration establishing a ‘Strategic Partnership’ between the two nations to take their bilateral relations to new heights. This framework extends beyond economic cooperation to include other areas such as defence, culture and science and technology. The primary goal of economic and trade cooperation under this framework is to enhance bilateral trade and direct investment between the two countries. In economic terms, the Strategic Partnership Framework seeks to deepen trade and investment linkages and to strengthen financial cooperation, especially in support of infrastructure development in India and greater financial residence. To operationalise this, the two countries agreed to establish a regular financial dialogue and created a Joint Working Group (JWG) between India’s Ministry of Commerce and Industry and Singapore’s Ministry of Trade and Industry to address bilateral trade and investment issues.

Beyond bilateral cooperation frameworks, the trade and investment relationship between India and Singapore is also significantly influenced by multilateral cooperation frameworks between India and ASEAN countries. Notable examples include the ASEAN–India Framework Agreement on Comprehensive Economic Cooperation (2003), the ASEAN–India TIG Agreement (2009) and the ASEAN–India Investment and Services Agreement (2014).

India–Singapore Trade Relations

The trade relationship between India and Singapore within the framework of India’s Act East Policy is a prime example of the increasingly deep economic and strategic cooperation between the two nations. The Act East Policy, upgraded from the original Look East Policy in 2014, aims to strengthen relations with Southeast Asian countries. Singapore is one of India’s most important strategic partners in the region. This article analyses India–Singapore trade relations before and after the implementation of the Act East Policy in 2014.

India–Singapore Trade Relations Before the Act East Policy

Singapore was the first ASEAN country to sign a trade agreement with India, and the two nations’ historically strong economic ties have contributed to the growth of their trade relations. The India–Singapore CECA played a significant role in promoting bilateral trade. This section analyses trade outcomes between the two countries from the signing of CECA in 2005 until 2013.

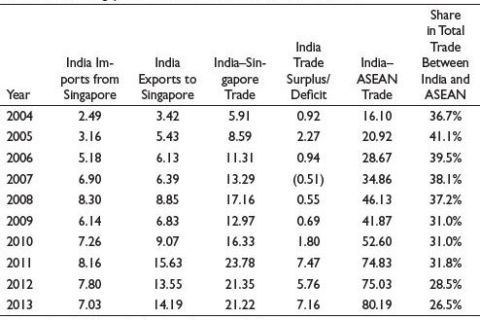

Tracking India–Singapore trade results from 2004 to 2013 shows a positive trend. Notably, after the signing of CECA in 2005, bilateral trade witnessed significant growth. During this period, total trade between the two countries rapidly increased from $5.9 billion in 2004 to $23.78 billion in 2011, a fourfold rise (Table 1). However, bilateral trade slightly declined between 2011 and 2013, dropping from $23.78 billion in 2011 to $21.22 billion in 2013. This fluctuation was largely due to changes in India’s export performance to Singapore, while imports from Singapore remained relatively stable. A deeper analysis reveals that the decline was primarily driven by exports of mineral fuels, mineral oils and products of their distillation, as well as bituminous substances and minerals (Chapter 27). India’s exports in this category surged in 2011 but gradually decreased in the following years. The global economic recovery after the 2008–2009 financial crisis led to increased demand for fuel and mineral oils. Economic recovery in developed and developing countries has created a higher demand for energy products. Additionally, the sharp rise in crude oil prices in 2010–2011, which remained high before declining in late 2014, provided opportunities for Indian producers to boost export revenues from petroleum products.

From 2004 to 2013, India maintained a trade surplus with Singapore, steadily increasing from $0.92 billion to $7.16 billion by 2013. Singapore’s economy, which heavily relies on trade and imports most of its products due to limited natural resources, generated a high demand for industrial, technological and pharmaceutical products from India, contributing to India’s trade surplus. During this period, India’s primary exports to Singapore included mineral fuels, oils and ships and boats.

During 2004–2013, Singapore consistently ranked as India’s top trading partner in ASEAN, accounting for approximately 26.5%–41.1% of total trade between India and ASEAN. However, the share of trade between India and Singapore began to decline after 2009, when India signed the AIFTA on TIG. The signing of this free trade agreement boosted trade between India and other ASEAN countries, increasing India’s trade with ASEAN from $41.87 billion in 2009 to $52.6 billion and further to $74.83 billion by 2011. While the FTA stimulated trade between India and other ASEAN nations, it also decreased Singapore’s share of total trade between India and ASEAN.

Table 1. India–Singapore Trade Results for the Period 2004–2013.

Source: Compiled from the http://trademap.org database.

Notes: Unit: Billion USD. ASEAN: Association of Southeast Asian Nations.

India–Singapore Trade Relations After the Act East Policy

In September 2014, Prime Minister Narendra Modi rebranded the Look East Policy as the Act East Policy, signalling a proactive approach to affirming India’s role and position in Asia through closer ties with Southeast Asian countries. The India–ASEAN relationship was elevated to a comprehensive strategic partnership in 2022, demonstrating the seriousness and commitment of both sides in promoting cooperation and addressing shared challenges.

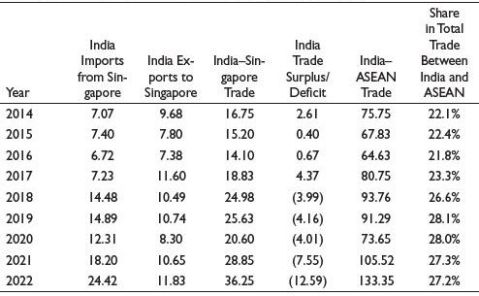

From 2014 to 2022, bilateral trade between India and Singapore showed an upward trend, underscoring Singapore’s significant role in India’s Act East Policy. Total trade between the two countries more than doubled, rising from $16.7 billion in 2014 to $36.25 billion in 2022 (Table 2). During this period, India’s exports to Singapore remained relatively stable, while imports from Singapore significantly increased, particularly from $7.23 billion in 2017 to $14.48 billion in 2018. This growth was primarily driven by increased imports in sectors such as electrical machinery and equipment (Chapter 85), mechanical appliances (Chapter 84), organic chemicals (Chapter 29) and mineral fuels and oils (Chapter 27), reflecting India’s rising demand for machinery and production equipment.

India’s trade with Singapore accounts for a substantial share of its trade with the ASEAN region. Between 2014 and 2017, Indonesia surpassed Singapore as India’s top trading partner in ASEAN. However, from 2018 to 2021, Singapore reclaimed its position as India’s leading partner, with rapid export growth from Singapore to India. Trade data from this period indicate a shift in India’s trade balance with Singapore, moving from a surplus (2014–2017) to a deficit (2018–2022), reflecting changing demand dynamics between the two countries.

Table 2. India–Singapore Trade Results for the Period 2014–2022.

Source: Compiled from the http://trademap.org database.

Notes: Unit: Billion USD. ASEAN: Association of Southeast Asian Nations.

In 2022, bilateral trade continued to flourish, with India’s imports from Singapore reaching $24.42 billion and India’s exports to Singapore totalling $11.83 billion. India exported 5,198 items to Singapore in 2022, with mineral fuels, mineral oils and related products generating roughly $6.1 billion of the total export revenue. This was followed by nuclear reactors, boilers, machinery, mechanical appliances and parts, contributing $595.71 million. In the same year, India imported 4,211 items from Singapore, totalling $24.42 billion. Nuclear reactors, boilers and machinery represented the largest category at $3.4 billion, followed by electrical machinery and equipment, sound and televisions, valued at $3.1 billion.

India–Singapore Investment Relations

The investment relationship between India and Singapore serves as a crucial economic bridge and a testament to the strong cooperation between these two leading nations in Southeast Asia. Singapore is viewed as a gateway and a guide for India as it navigates the ASEAN market. Singapore has proven to be one of India’s most important economic partners and its largest investor.

Singapore’s Investment in India

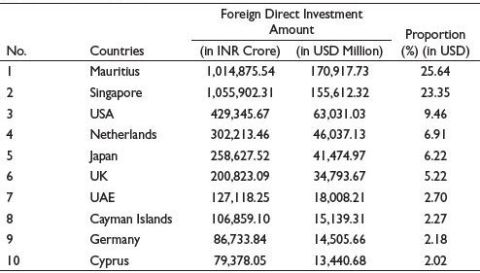

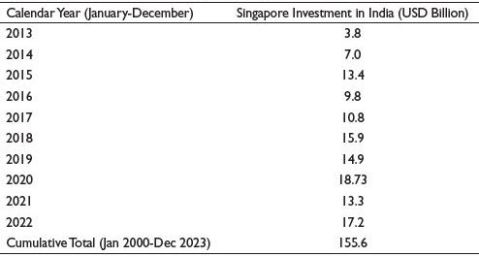

The amended DTAA arrangements, together with CECA, have significantly improved the attractiveness of India as an investment destination for Singapore-based capital. Over the past 23 years, from 2000 to 2023, total investments from Singapore into India exceeded $155 billion (Table 3), accounting for over 23% of total foreign direct investment (FDI) inflows into the Indian economy. Even during the COVID-19 pandemic, Singapore retained its position as India’s largest source of FDI among ASEAN countries, with an inflow of $15.9 billion in the fiscal year 2022.

This impressive figure not only reflects the trust and commitment of Singaporean investors in the Indian market but also highlights the effectiveness of the economic relationship between the two nations. The exchange of knowledge, skills and resources between India and Singapore creates valuable investment opportunities and promotes sustainable development and close cooperation between the two economies. By strengthening these connections, India and Singapore are solidifying their economic partnership and are paving the way for a prosperous and promising future in the international market.

Another reason behind the significant investment from Singapore into India is the influence of the Indian diaspora, which has played a crucial role in promoting Singapore’s investment in India. Singapore has a large and vibrant Indian community, accounting for about 9% of the country’s population (CIA, 2021). This creates strong cultural, social and business ties between the two countries. The Indian community has been in Singapore for a long time, contributing to the country’s cultural and social development while maintaining close connections with their homeland. Many Indians in Singapore are successful entrepreneurs and investors with extensive business networks in both Singapore and India. They act as essential bridges in fostering investment and economic cooperation. Indians in Singapore are often highly skilled professionals in fields such as IT, healthcare, finance and education, contributing positively to Singapore’s economic development. The presence of the Indian diaspora creates strong business and social relationships, helps build cultural bridges and enhances cooperation between the two countries. This creates a favourable and attractive environment for bilateral investment and economic development activities.

Table 3. Investment Data from the Top 10 Countries in India (Cumulative from April 2000 to December 2023).

Source: Department for Promotion of Industry and Internal Trade (2025) and DPIIT (2023).

FDI inflows from Singapore to India in 2022 were at $17.2 billion. In 2020, despite the pandemic, Singapore remained the largest source of FDI into India, with FDI inflows of $18.7 billion compared to $14.9 billion received in 2019 (Table 4). In 2020–2021, despite the pandemic, Singapore remained the largest source of FDI into India, with FDI inflows of $17.42 billion compared to $14.67 billion received in 2019–2020.

Singapore has also emerged as a significant source of external commercial borrowing and FDI for India. Over the years, a substantial portion of Singapore’s FDI in India has been directed towards manufacturing. Furthermore, service sectors such as finance and insurance, telecommunications, pharmaceutical research and development and information and communication technologies have attracted a considerable share of FDI. A significant portion of Singapore’s investment is dedicated to infrastructure development projects, including the upgrading of India’s airports and seaports, as well as the development of IT infrastructure and Special Economic Zones (SEZs).

Among Singapore’s notable investments, Temasek and Warburg Pincus purchased $500 million shares from existing investors in Ola in a secondary deal in July 2021. Lenskart raised $220 million from Temasek and Falcon Edge Capital, and ShareChat, an Indian content-sharing platform, secured $145 million in new funding from Temasek Holdings and two other investors.

Over 80% of foreign bonds issued by Indian entities are listed on the Singapore Exchange (SGX). Singapore-based investors manage assets worth over $100 billion in India. Temasek Holdings, Singapore’s sovereign wealth fund, invested $400 million in India’s National Infrastructure Investment Fund in 2018. Singapore’s sovereign fund’s current portfolio in India is $13 billion (India High Commission in Singapore, 2023).

Table 4. Singapore Investment in India 2013–2023*.

Source: Department for Promotion of Industry and Internal Trade

https://www.dpiit.gov.in/static/uploads/2025/07/be168cacb0001568b67d905aabf374a5.pdf

More than 440 Singapore-registered companies operate in India, supported by agencies such as Enterprise Singapore, the Economic Development Board and the Singapore Tourism Board, all of which maintain offices in India. Leading Singaporean firms in the Indian market include Development Bank of Singapore (DBS), Flextronics Technologies, The Hub Engineering, Singtel Global, Singapore Technologies Telemedia (STT) Global Data Centres, Lee & White (L&W) Construction, American President Lines (APL) Logistics, Olam Agro, Quest Global Engineering Services and United Overseas Bank. Their activities span banking, logistics, electronics, data centres, telecommunications, agribusiness, engineering services and construction. According to Mr Peter Ong Boon Kwee, the chairperson of Enterprise Singapore, Singaporean companies are increasingly collaborating with Indian corporations and business partners, particularly in tapping opportunities in the development of MedTech, rural technology, e-commerce and smart city projects (The Economic Times, 2020).

During Prime Minister Narendra Modi’s 2015 visit to Singapore, he invited Singaporean investors to participate more actively in India’s transformation, describing Singapore as a ‘nursery for India’s laboratory’ in the effort to build a competitive manufacturing base and modern infrastructure.

India’s Investment in Singapore

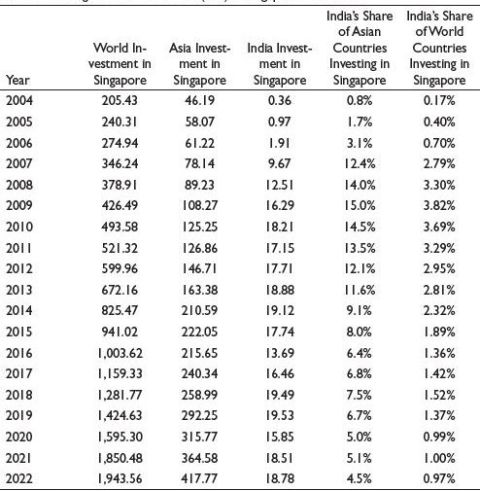

India’s investment in Singapore grew from $0.36 billion in 2004 to a peak of $19.53 billion in 2019 before slightly declining to $18.78 billion in 2022 (Table 5). A notable increase occurred in 2007, with investments reaching $9.67 billion, and the upward trend continued in the following years, culminating in 2019. India’s share of investment compared to other Asian countries rose from 0.8% in 2004 to 15.0% in 2009 before gradually decreasing to 4.5% in 2022. From 2007 to 2010, India held a significant portion of Asian investment in Singapore, peaking at 15.0% in 2009. Indian investment in Singapore experienced considerable growth, especially during 2007–2010. However, after 2010, India’s share of investment relative to Asia and the world gradually declined. Although Indian investment peaked in 2019, it saw a slight decrease afterwards, with its share compared to other Asian and global countries also trending downwards after the peak period of 2007–2010.

Singapore’s open economic regime has been an important pull factor for Indian firms and professionals. The city-state welcomes highly skilled workers in IT, engineering, medicine and finance, and major Indian banks such as the State Bank of India, Industrial Credit and Investment Corporation of India (ICICI), Bank of India and Indian Overseas Bank have long maintained operations there. The presence of Indian companies in Singapore has also grown significantly, with approximately 9,000 Indian companies registered in Singapore (India High Commission in Singapore, 2023). This includes prominent public sector units, banks and trade organisations like India Tourism, Confederation of Indian Industry (CII) and Federation of Indian Chambers of Commerce and Industry (FICCI), all of which have offices in Singapore.

Table 5. Foreign Direct Investment (FDI) in Singapore 2004–2022.

Source: Compiled from Department of Statistics Singapore (2025), www.singstat.gov.sg.

Note: Unit: Billion USD, %.

A predictable regulatory framework, efficient infrastructure and a competitive tax regime have encouraged many Indian companies to use Singapore as a base for their manufacturing, services and regional headquarters activities, especially for Asia–Pacific operations. Strong air connectivity and the presence of a large Indian community further reinforce Singapore’s attractiveness as an overseas hub for Indian business.

Science and technology cooperation has developed in parallel with these investment ties. The two countries collaborate in aerospace, space programmes, aeronautical engineering, biotechnology and energy. Financial integration has also deepened: crucial index derivatives linked to India’s Nifty 50, including Gift Nifty or SGX Nifty, are listed and traded on the SGX (Mayanglambam, 2024).

Looking ahead, India’s sustained economic growth, expanding consumer market and emerging opportunities in e-commerce, technology, biotechnology and renewable energy make it an increasingly attractive partner for Singapore investors. Policymakers in Singapore see New Delhi as a major long-term opportunity in their regional economic strategy.

In February 2023, a landmark digital payment linkage between India’s Unified Payments Interface (UPI) and Singapore’s PayNow was launched. This arrangement enables faster, more cost-effective cross-border remittances and supports small-value retail payments by individuals and businesses in both countries. The PayNow–UPI linkage is expected to lower transaction costs and further facilitate business and people-to-people exchanges.

Conclusion

India and Singapore have built a multifaceted partnership that combines deep historical ties with modern economic and strategic cooperation. Singapore has become one of India’s main trading partners in ASEAN and a leading source of FDI, external commercial borrowing and foreign portfolio investment. At the same time, India has emerged as a significant investor in Singapore and increasingly uses the city-state as a springboard for its broader engagement with East and Southeast Asia.

Bilateral relations are sustained by a dense web of institutional linkages, including CECA, the DTAA, the Strategic Partnership Framework, and various sector-specific initiatives in finance, science and technology, education and connectivity. These arrangements have facilitated the rapid expansion of TIG and services, strengthened investment flows, and created new forms of cooperation in areas such as infrastructure, digital finance and smart-city development.

Moreover, there is significant alignment on a wide range of international issues. Both countries are members of several forums, including the G20, the Commonwealth, the East Asia Summit, IORA and IONS. These are solid foundations for further strengthening trade and investment cooperation between the two nations in the future. Jawed Ashraf, India’s High Commissioner to Singapore, has praised Singapore’s role and position in advancing India’s Act East Policy, noting that Singapore has, in many ways, shaped India’s engagement with ASEAN. ‘In many ways, Singapore has led or shaped India’s engagement with ASEAN and beyond, and it is a crucial partner in advancing India’s Act East Policy’, he remarked.

Declaration of Conflicting Interests

The authors declared no potential conflicts of interest with respect to the research, authorship and/or publication of this article.

Funding

The authors received no financial support for the research, authorship and/or publication of this article.

CIA. (2021). Singapore. https://www.cia.gov/the-world-factbook/about/archives/2021/countries/singapore/

Department for Promotion of Industry and Internal Trade. (2025). India offers the three Ds for business to thrive—Democracy, Demography, and Demand. We are committed to making India the most investment-friendly country in the world. https://dpiit.gov.in/

Department of Statistics Singapore. (2025). Investment. https://www.singstat.gov.sg/, https://www.singstat.gov.sg/publications/reference/ebook/trade-and-investment/investment

DPIIT. (2023). FDI statistics. https://www.dpiit.gov.in/static/uploads/2025/07/be168cacb0001568b67d905aabf374a5.pdf

India High Commission in Singapore. (2023). India–Singapore relations.

Mayanglambam, R. (2024). Key business opportunities for Singapore companies in India, 2024. https://remunance.com/blog/key-business-opportunities-for-singapore-companies-in-india-2024/

Statista. (2024). Foreign direct investment inflow from Singapore to India from 2013 to 2022, with an estimate for 2023.

The Economic Times. (2020). Singapore companies increasingly collaborating with Indian counterparts. https://economictimes.indiatimes.com